Germany's economy started contracting in the second quarter of 2008, and went officially into recession in third quarter. Further the Federal Statistical Office estimated this week that the economy may have shrunk quarter on quarter by as much as 2 percent in the fourth quarter (ie at an annual contraction rate of 8%), and that annual growth for 2008 may have been as low as 1.3 percent (non calendar adjusted - 1% calendar adjusted) - about half the 2007 level.

Was any of this foreseeable? Well I was predicting annual GDP growth in the 1.3/1.4% range for 2008 back in July last year (see this post on RGE Monitor), and I have attempted to raise an alert about the possibility of Germany falling into deflation (this post here), a risk I now think to be real and immediate with a contraction in GDP of between 2% and 5% (which I think is where we are, and it wouldn't surprise me to see the 2009 number coming in at the steeper end of this range. I mean I think there is more bad news coming in Southern and Eastern Europe that has not been factored-in yet).

Germany’s inflation rate fell to its lowest in more than two years in December, declining to a 1.1 percent annual rate from 1.4 percent in Novembe. That’s the lowest level since October 2006.

“With inflation in Europe’s largest economy dropping at that speed, the ECB has all the legitimacy it needs to cut rates rapidly,” said Jens Kramer, an economist at NordLB in Hannover. “German inflation will actually turn negative by the middle of the year.”

Month on month prices actually rose 0.4 percent, and in fact both the general and the core indices spiked upwards at the end of last year (see chart), but given the extent of the contraction which we can expect, I really don't think that this is going to be very typical.

And The German Labour Market Has Finally Turned

Unemployment in Germany rose last month for the first time since February 2006, thus bringing inauspiciously to an end an unprecedented 34 month labour-market recovery. Figures released by the Federal Labour Agency last week show that the number of those seeking employment in Germany rose by a seasonally-adjusted 18,000 in December. The change is small, but the significance is great, since this is obviously but the first month of many when unemployment will rise in Germany, and this rising unemployment will now, in its turn, feed back into the industrial slowdown which is already underway. The seasonally adjusted unemployment rate remained unchanged (following data revisions for previous months) at 7.6 percent.

This is hardly a surprise, but it is certainly not good news.

In a separate release the Federal Statistical Office reported that the number of persons in employment living in Germany was 40.83 million in November 2008 - up by 500,000 persons on the same month a year earlier. However, the relative increase (+1.2%) was the lowest rate of growth since December 2006. In January 2008, the relative increase compared with a year earlier was 1.7%. So the economic downturn is finally beginning to show up in the labour market, too.

As compared with October 2008, there were 12,000 more people working which compares with an average increase of 53,000 in November 2005, 2006 and 2007.

Exports Drop Sharply In November

The reasons for the uptick in German unemployment are not hard to find, since German exports fell back at a record rate in November - in fact seasonally and working day adjusted current-price sales exports fell back 10.6 percent from October (when they declined 0.6 percent), according to the latest data from the Federal Statistics Office. This is the biggest monthly drop since records for a reunified Germany began. November exports dropped 12 percent year on year, while imports fell 5.6 percent on the month and 0.9 percent from a year earlier. The trade surplus (which is the key consideration when it comes to GDP growth) narrowed to 9.7 billion euros from 16.4 billion euros in October, and almost half the April rate of 18.8 billion euros. The current account surplus was down to 8.6 billion euros.

The immediate future looks even worse, with the latest data from the Technology Ministry showing new orders fell 27.2% (on aggregate) in November (as compared with November 2007) following a 17.5% annual reduction in October, while export orders fell back 30% year on year.

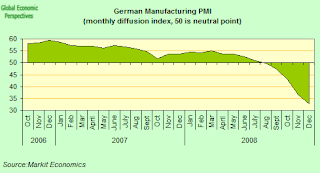

In fact it has been the sharp drop in orderswhich has sent Germany's manufacturing sector into headlong contraction, and the sector shrank at the fastest rate in over 12 years in December, with the Markit Purchasing Managers' Index (PMI) falling to 32.7 - down from 35.7 in November. The reading, which showed the sector contracting for the fifth month running, was the lowest since the series began in April 1996, while the sub-index for new orders also fell to a series record low.

Fiscal Deficit Worries

So what can the German government do? Well quite little at this stage of the game I think. Obviously the ECB can (and should) be taking steps to move into line with the Federal Reserve and the Bank of Japan and start readying up some sort of "European" version of quantitative easing, but as far as the national government goes, then I think we are near to the hang on tight and keep your fingers crossed stage. Chancellor Angela Merkel's governing coalition did agree this week to a further 50 billion euro economic stimulus plan which includes items like investments in infrastructure, and tax relief and payments for families with children. This follows an earlier plan worth 23 billion euro, which was criticized at home and abroad as being too cautious.

But what I think most observers don't appreciate sufficiently is that in an export-driven economy, where population ageing means that domestic consumption is simply not going to take up the slack and drive the economy, then there is simply a limit to what any government can do - without spending money which is going to be badly needed to pay future pension and health care costs, that is. German Finance Minister Peer Steinbrueck admitted in a newspaper interview with Financial Times Deutschland that he now expected Germany's fiscal deficit to exceed 4 percent of gross domestic product in 2010 taking into account the latest stimulus plan. The issue here isn't simply that EU rules require member states to rein in deficits to no more than 3 percent of gross domestic product (and cap national debt at not more than 60 percent of GDP), we are in an emergency and emergency measures are needed.

But EU member states also agreed in April 2007 to balance budgets by 2010, and Germany had been very critical of France for saying they would not be able to meet this target. Germany had already violated the deficit rule for four straight years between 2002 and 2005.

"Of course I would have liked to present you with proof at the end of the legislative period that we would manage to have a budget without new borrowing in 2011. Under normal circumstances, we would have managed that," Steinbrueck said. "But we are dealing with a sharp recession, an enormous financial crisis and a crisis in the auto sector."

The point is that falling back on this target will not come cheaply, in the sense that balancing the books was agreed to for a reason - the need to meet the costs of sustaining a society with a rapidly rising elderly dependency ratio. There is a lot of discussion of widening eurozone bond spreads in the eurozone at this moment, but I find myself asking one simple question: if investors start to get worried about the sustainability of German financing, whose bond will become the benchmark against which the other spreads will rise, France's perhaps?

"A balanced budget remains our target because the demographic changes in Germany will increasingly have an effect from the middle of the coming decade. We must not overburden the younger ones," Merkel said.

Black Hole In The Banking System?

And there aren't only holes in the real economy to try and plug (with cement), the financial sector is also becoming an apparently bottomless pit, with the government being poised on Friday to step in and part-nationalise a second bank. Hypo Real Estate is once more in emergency talks with Germany's bank rescue fund about a deal that looks likely to give the government a stake in the troubled investment bank. These negotiations draw a difficult week for the German banking sector to a close, following the announcement by Deutsche Bank of a 4.8 billion trading loss in the last three months of 2008 (which compares with a profit of about 1 billion euros a year earlier) while landesbank WestLB prepared to warehouse risky investments. WestLB wrote to its owners, local savings banks saying it needed to park troubled assets off its balance sheet in order to stage a recovery - the value of the doubtful assets involved is thought to be about 50 billion euros.

Munich-based Hypo Real Estate on 12 January received an extension until April 15 on a 30 billion-euro framework guarantee provided by Soffin, Germany’s bank-rescue fund. The lender said at the time that talks with Soffin regarding more extensive and longer-term liquidity and capital support measures are continuing. Commerzbank AG, Germany’s second-biggest bank, got a second state bailout on 8 January to strengthen its capital following the acquisition of rival Dresdner Bank from insurer Allianz SE. The German government in return agreed to take a stake of 25 percent plus one share in the combined Commerzbank-Dresdner.

And there is more to come, much more. Der Spiegel is reporting that the major German banks have so far written off only around a quarter of the nearly 300 billion euros in toxic U.S. assets they have on their books. The finance ministry in Berlin estimates that the entire German banking sector is carrying around 1000 billion euros of risky assets on its books, according to Der Spiegel. The government has aset up a 480 billion euro rescue fund to provide fresh capital or lending guarantees to the financial sector, and has already committed 100 billion of the 400 billion set aside for loan guarantees and 18 billion of the 80 billion earmarked for capital injections. However, some see even this as insufficient and there have been mounting calls for the creation of a "bad bank" that would buy up risky bank assets.

Finance Minister Peer Steinbrueck was quoted by the Frankfurt Allgemeine Sonntagszeitung weekly newspaper as saying he could "not imagine (such a step) economically or above all politically". A bad bank would need to be financed with 150 billion to 200 billion euros of taxpayer funds, he said. "How am I supposed to present that to parliament? People would say we are crazy."

China Pushes Germany Into Fourth Place

And to add insult to injury, China this week announced that it had become the world's third-largest economy, surpassing Germany and closing in rapidly on Japan, according to Chinese government and World Bank figures. The Chinese government revised its growth figures for 2007 from 11.9 percent to 13 percent, bringing its estimated gross domestic product to $3.4 trillion, about 3 percent more than Germany's $3.3 trillion, based on World Bank estimates. Even though China's growth is now dropping rapidly - and some estimates suggest it may only be 6% in 2008, Japan's is currently shrinking, and the growth differential is sure to remain, however bad China's performance actually does turn out to be in 2009 and 2010. Hence I don't think it will be that many years before China's GDP manages to overtake Japan's, which is currently estimated to be worth around $4.3 trillion.

No comments:

Post a Comment