The Italian government, Mario Monti informed the country's parliament last Thursday, is now planning to concentrate its attentions on achieving economic growth. A timely decision this, since the statistics office announcement a day earlier that the country had once more fallen back into recession, while not being a surprise nonetheless does constitute a cause for concern. Not that Italy is any stranger to recession, since the country has now had five of them since entering Europe's Monetary Union at the turn of the century. In fact the Italian economy has now contracted in eight of the last 15 quarters, and GDP is back in the good old days of 2003, stuck below the level it first attained in the first three months of 2004. And of course it is now going backwards in time again. Depending on the depth of the recession now being provoked it is touch-and-go whether the economy might not at some point even revisit levels last seen in the closing years of the 1990s. And remember, this is not deflation ridden Japan, this is real, not nominal GDP we are talking about here. So far Italy hasn't been experiencing deflation, or at least not yet it hasn't.

All in all, it would be hard to say that the Euro has worked well for the Italians. Maybe it was a great opportunity that the country was unable to take advantage of, but in any event all they are going to see from here on in is the downside part of it. The inability to adjust the value of a domestic currency they don't have to compensate for all that wantonly lost competitiveness means they are going to have to do things the hard way, subjecting themselves to a collective ingestion of codliver oil the like of which the country has not seen since the harsh days of the1920s.

Sinking Below Ground

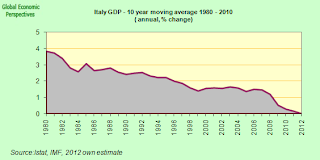

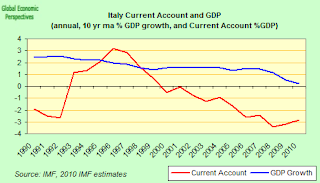

The extent of the problem the country now has can be easily seen in the chart below, which shows annualised growth over a decade (as a moving average). What is absolutely shocking is that in the ten years up to 2010 Italy had an average annual growth rate of just 0.28%. Assuming growth of about 0.5% in 2011 (which may now be generous), in the decade to 2011 this will drop to 0.15%, and if we pencil in a contraction of 1% in 2012 (perfectly realistic, in fact it will probably be worse) then the number turns negative. That is to say, on average the Italian economy will have shrunk every year for a decade.

Some may say that this result is in part a by-product of the global crisis, and they would be partly right. But look at the trend over the last three decades, far from seeing some stylised version of steady state growth hovering around a constant mean, the rate of expansion in Italian output has been heading relentlessly downwards, so logically it was always bound to cross the zero line at some point. That point now seems to be about to arrive in 2012, a year which may mark a before and after in modern Italian history.

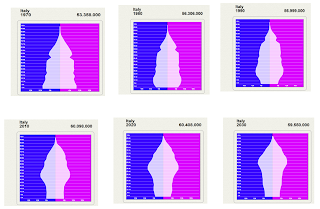

Naturally, the reason why Italian growth has fallen so far is the big point at issue here. One of the reasons is obviously a competitiveness loss resulting from higher than Eurozone average inflation sustained over a long period, but another component is possibly the impact of population ageing, which has hit Italy more than any other European country except for Germany, and it is with Germany, of course, that Italy has the largest competitiveness loss. Demographically speaking Italy is Germany minus all that export competitiveness.

Looked at from another angle, like many other countries Italy probably grew rather over trend in the years between 2004 and 2007, and then dropped back sharply in 2008. But the Italian economy fell further than most of its peers, and subsequently really failed to recover. This is the clearest demonstration of the competitiveness problem, and it won't be easy to address.

It's The Competitiveness Silly!

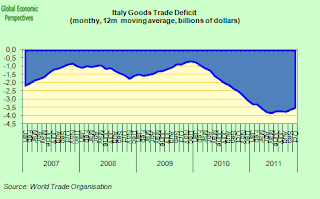

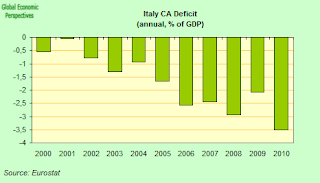

As is well known Italy is weighted down by a massive burden of public debt (120% of GDP). Even before the recent surge in Italian bond yields servicing this debt consumed an onerous volume of government income. But this debt alone does not explain why Italy has such a poor track record. Japan, for example, has a debt burden of over 200% of GDP and still manages to eke out a better growth trajectory. The two countries are similar in that domestic demand is permanently weak (they both have elderly populations, with a median age of around 45) yet difference between the two countries is obvious, since Japan (like Germany) has a large and dynamic export sector which generates a trade and current account surplus, and this buoys investment and GDP growth. Italy, on the other hand, has a trade and current account deficit, and both of these have been worsening since the end of the last recession.

Naturally a negative trade balance weakens the GDP reading, given the impact of the net trade effect, but curiously the recent GDP slowdown has been associated with a drop in government spending (which is what previously had been sustaining Italian GDP in positive territory), a fall in domestic consumption, and a consequent fall in imports (which is why the trade balance has been improving somewhat of late). Indeed, the reduction in imports meant that the net trade effect was one of the few positive points in the latest GDP reading - even while the economy contracted by 0.2% net trade added 0.8 percentage points to what would otherwise have been a devastatingly bad number. So there is no need to call in inspector Clusot to find out what happened, it was clearly the sharp cut in government consumption that finally killed off the fragile Italian recovery, although naturally, given that government debt was - and has been for some years - on an unsustainable path, the spending tap had to be shut off at some point. What Italy now needs - like so many of the countries on the EU periphery - is a sharp improvement in international competitiveness and a significant surge in investment into the export sector. The two of these naturally go together, since few will invest in activities which are unlikely to be competitive and profitable.

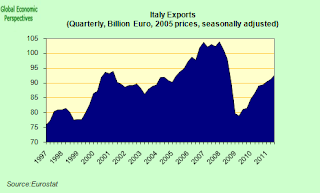

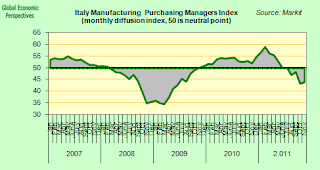

Italy does have a stronger export sector than some of its Southern European counterparts, and exports did surge as the global economy started to recover (see chart above), but they never managed to reach their pre crisis level, and now, at least according to the latest PMI surveys, they are weakening once more as the European and global economy slows.

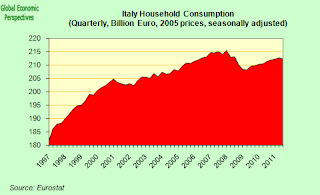

Italy was far from having a consumer boom during the good years of the first decade of this century. In fact household consumption grew by less than 5% between 2000 and 2008, and in any event the pace was much slower than in the 1990s (see the shift in steepness of the slope in the chart below).

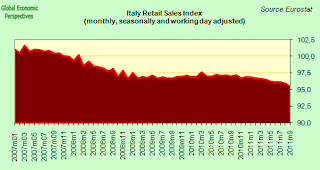

Retail sales have been falling since 2007.

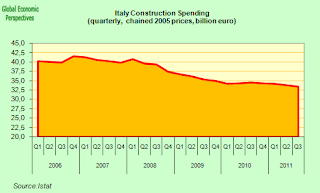

And construction spending has been one steady slide down.

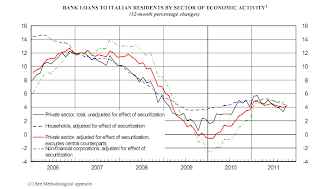

And yet, despite all the pressure on Italian banks there is (as of October) no sign yet of a sharp credit crunch affecting either firms or households, since private sector credit is still growing at an annual rate of around 4%, a stark difference from the picture in Greece, Spain, Ireland and Portugal where private sector credit is steadily contracting.

No Boom, No Bust

So to be clear, Italy did not have any sort of housing or credit driven boom during the first decade of the century, Italian households and companies are not massively in debt when compared with their Euro Area peers, and credit is not in especially short supply. Ageing population dynamics lead domestic consumption to be weak in Italy (following a pattern which is strikingly similar to that seen in Japan and Germany), yet Italy's export sector has been allowed to drift as competitiveness has been lost. Really the most telling chart I have is this one, which shows how as the current account surplus has widened (ie as competitiveness has been lost) long term growth has steadily declined.

With neither exports nor private consumption able to pull the economy the state has been under constant pressure to offer support via deficit spending, leading to the accumulation of an unsustainable quantity of government debt. This deficit spending is about to come to an end (permanently according to the latest EU agreement), and under these circumstances the economy is likely to remain in or near contraction for as long as it takes to recover competitiveness. The question is, how long is that going to be, and what will happen to the debt dynamics in the meantime.

To take the second question first, one of the reasons that many are confident Italy will make it on through with the debt challenge is the country's recent record in controlling the deficit. According to OECD data, while Italy ran a cyclically adjusted primary deficit every year between 1970 and 1991, it ran a cyclically adjusted primary surplus every year since 1992. That is to say, before allowing for interest payments Italy has not been running a deficit for many years now, and it is simply the burden of servicing the accumulated debt which is causing the country to spend more than it receives in revenue. As many of those who are in the "optimistic" camp on the question of the country's ultimate solvency eagerly point out, Italy’s cyclically adjusted primary balance as a proportion of GDP has remained in a better shape than those of the largest developed countries as well as those of European peripheral and core countries since the onset of the crisis. It is only the legacy of the past which acts like a dead weight pulling the country down, but what a legacy this is, and especially as yields on Italian debt have steadily risen.

Poised On A Knife-edge

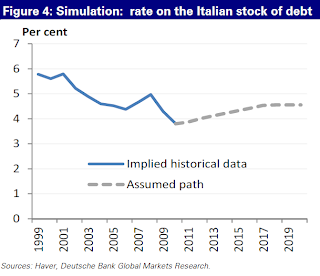

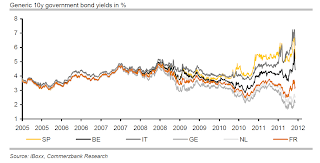

But given everything it is clear that Italian debt, and with it the future of the Euro, now sits poised on a knife edge, as is illustrated in the chart below (which comes from Barclay's Capital). If you take a neutral scenario where Italy has a balanced budget and a sum total of zero nominal GDP growth (ie growth+inflation = 0) debt stays put at 120% of GDP out to infinity.

But then imagine the average finance cost of Italian debt rises, and stays high. In this case the only way to compensate is by running a larger primary surplus (ie more spending cuts, or revenue increases to compensate for the extra interest cost). The net effect of this would either be to generate deflation or a more sustained economic contraction, in which case debt to GDP would start to rise indefinitely. Think of it like this, either prices fall by one percent and GDP (via exports) rises by 0.5% (for example), in which case nominal GDP falls 0.5% a year (the Japan type case), or prices rise by 0.5%, exports lose more competitiveness, and so growth falls by 1%. I mean, this example is only illustrative, but it is meant to give some sort of feel for what "knife edge dynamics" really mean.

In fact, before the recent surge in the spread, average interest costs on Italian debt had been falling in recent years, but now they are evidently rising again. It is very important here to remember that yields in bond auctions only affect new emissions of debt (and changes in the secondary market only really affect banks, and sovereigns through possible needs to recapitalise banks). So it is a question of years before the higher levels "lock in" - the average maturity on Italian debt, for example, is around 7.2 years, and indeed since governments finance at fixed and not floating rates (not at a certain % above 3 month Euribor, for example), debt costs are at much at risk from increases in ECB base rates as they are from the actual spread with German bonds. Any substantial increase in interest costs naturally makes selling debt more expensive. Fortunately for peripheral sovereigns, the likelihood of ECB rate rises in the foreseeable future is near to null.

No Way Back Home

But again, let's do another thought experiment. Imagine I am right, and Italian debt is on a knife edge path, and suppose the average interest rate on the whole debt creeps up by 1 percentage point. With debt at 120% of GDP, then the primary surplus to cover the added interest costs and maintain a balanced budget would be 1.2% of GDP. But suppose, for the sake of argument, that increasing the primary surplus by 1.2% pushes Italian debt to gdp up to 125% (via a combination of either deflation or economic contraction), then the next year the primary surplus would need to be up by an additional 0.05%, helping force debt to GDP up even further and so on and so forth. This is why people call this the debt snowball. The point is, whichever way you turn, you seem to find the exit door locked.

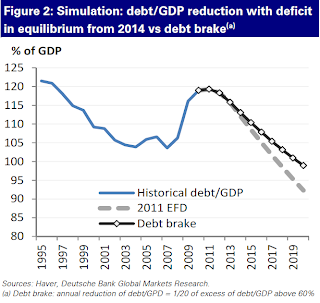

Coming back to the details of the present situation, the Italian government has committed itself to a consolidation program worth €74bn over the next two years amounting to roughly 3.7% of GDP. This is designed to bring the budget into balance (or the deficit to zero) by the end of 2013. On quite conservative assumptions, just to tread water, and maintain the debt level where it will be in 2013 (which will be more than 120% of GDP due to the recession), Italy will need a primary surplus of 2.3% of GDP.

But then we need to think about the recently undertaken commitment to reduce the debt (the last EU summit). The exact numbers have yet to be agreed for the new pact, but it looks like a cyclical maximum of 0.5%, and (even more importantly) a commitment to reduce outstanding debt over 60% of GDP by 5% a year. This, in Italy's case will mean the country is going to need (from 2014 onwards) a primary balance of something like 5.5% of GDP (depending on the evolution of interest costs) over the rest of this decade. Which means the Italian economy is going to face an even more restrictive fiscal environment.

Now, those who argue the Italian crisis will have a happy outcome point to history, and argue that Italy was able to achieve a primary surplus of around 5% on average during the years 1995-1998, so why shouldn't the country be able to do this again? The main counter argument would be that that was then, and this is now. That is to say, these were the years of Italian "coupling" with monetary union, sizable privatisation programmes, falling (not rising) interest rates, and basically Italian trend growth had not fallen as far as it has now.

Moreover, the external environment in Europe will not exactly be conducive to boosting exports. Even core Euro Area countries are commited to undertaking additional fiscal consolidation beyond what is currently envisaged in order to comply with the new debt rule. Taking 2014 as the starting point, debt to GDP for the Euro Area as whole might be something like 90%. Hence the 1/20th rule would imply that on aggregate the Euro Area will need to reduce its debt ratio by around 1.5 percentage points per year. If this agreement is complied with the adjustment will almost certainly imply a net fiscal drag on growth in the years following 2013. Of course, if it is not complied with then it will almost certainly be "bye bye Euro" (assuming the common currency still exists that far up the road).

It's All About Structural Reforms, Or Is It?

So basically, what the whole argument about whether or not Italy can make a final burst and reach the finishing line is all about structural reforms, and whether the country can get enough growth (quickly enough) to turn the "knife edge trap" around. Personally I am extremely doubtful that it can, which is why I placed so much emphasis on the growth performance in the first section. The turnaround needed here is massive. It is a 30 year decline we are talking about, and I doubt short of outright default and substantial devaluation we have historical examples of anyone doing this. The adjustment made in Germany between 1999 and 2005 was much smaller in comparison.

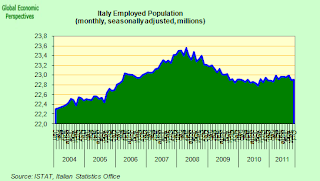

One of the proposals is to introduce labour market reforms to increase participation rates, but in fact the Italian labour force grew substantially between 2004 and 2008 (due to large scale immigration), with employment being up by over a million (or around 5%, see chart above), yet the increase in output was ridiculously small. On the other hand we know the Italian working age population is contracting (and the average age rising), while the elderly dependent population is increasing rapidly. Conventional economic models tend to be silent on this issue, but common sense should tell us that this is going to take its toll on growth - a factor the "structural reform answers all our problems people" don't seem to have given enough thought to.

The Monti government needed just five weeks in office to push through an additional 30 billion-euro emergency budget package, but how long will he need to get GDP growth back up above 1% annually? And how much time does he have? Investors initially cut him some slack, but judging by the reaction to the final approval of the package by the Senate - the yield on Italy’s 10- year benchmark bond was pushed up by 12 basis points to 6.91%, dangerously close to the key 7% level (although still somewhat below the Euro era record hit on November 9, just before Monti took charge). 7% is widely considered to be critical if sustained for any great length of time, partly due to the cost of debt servicing but also because of the level of dependence of Italian banks on the ECB that it would produce.

Till The Dowgrades Fall

So the "Full Monti" effect now seems to have been priced in, while investors nervously wait to see what the real plan for Spain and Italy actually is.

The first quarter of 2012 looks to be critical for Italian debt, with about one third of the total Euro Area debt maturing being Italian. Indeed the battle starts this week with the Treasury having to sell an assortment of T-bills and 2 year and 10 year bonds. In addition the Italian government is now increasingly guaranteeing bonds issued by Italian banks to be used as collateral at the ECB - with about 40 billion euros being issued last week according to some estimates. So effectively Italy is now more or less guaranteeing the banking system with the likely outcome that ratings agencies will be even harder on the sovereign rating.

Not that the outlook was exactly bright on that front anyway. Understandably, Italy was among the 15 Euro Area countries Standard & Poor’s placed on review for a possible downgrade on December 5. This follows an earlier downgrade to a single A by the agency in September. In addition, Spain and Italy were both warned by Fitch (which cut Italy's rating to A+ on October 8) on December 15 to brace for a further debt downgrade after concluding that a "comprehensive solution to the eurozone crisis is both technically and politically beyond reach". And to complete the set, Moody's, which cut the country to A2 on October 4, maintained a negative outlook, signifying that a further dowgrade in the coming months was highly probable The bottom line is that Italy is both too big to fail and too big to be bailed out, which is why it is still hanging dangerously in limbo-land. Since, as I argue in this article, some sort of restructuring or other is well nigh inevitable in the Italian case, the sooner Europe's leaders work up a credible plan on how to achieve this, the better. Otherwise it will not only be Italy's citizens who are subjected to the Full Monti, Europe's leaders may also find themselves with their credibility stripped naked.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Monday, December 26, 2011

Sunday, December 18, 2011

Is Finland Really A Closet Member Of The Eurozone Periphery?

Well, that was the week that was, wasn't it? It started with a cheerful, upbeat market response to both the impact of the ECB's 3 year LTRO and the growing impression that Hungary was going to make some sort of "one-off" deal with the IMF, and ended near the depths of despair as S&P's announced the downgrade of 9 Euro Area countries, while the EU Commission worked hard to reinforce the impression that it was about to launch legal proceedings that could even lead to the temporary suspension of Hungary from the EU. It was a time of bitter sweet experiences, which started with Tamás Fellegi (that's him smiling in the photo below) heading off for his scheduled interview with Christine Lagarde. Then we learnt that the German economy had grown by a brisk 3% in 2011, only to have our hopes dashed by the clarification that most of the growth was in the first 9 months of the year, and in fact the country probably entered recession in the last quarter.

Saturday, December 10, 2011

A Deep Seated Hostility Towards European Construction?

The British decision to veto the proposed new EU treaty is not surprisingly provoking an avalanche of commentary this weekend. Among journalists, at least, there seems to be a consensus that David Cameron committed some kind of major diplomatic blunder.

Possibly this is so, but given the difficulties presented by having to take this agreement forward outside the formal structure of the EU, it is hard to not reach the conclusion that both Angela Merkel and Nicolas Sarkozy have been guilty if not of a similar blunder, then at least a major error of judgement. On the other hand the issues involved in the proposed new arrangements are highly complex and in some senses ground breaking, so it is indeed suprprising that so many (and so diverse) countries were able to reach such rapid agreement on the need for and the broad outlines of a new agreement. While Angela Merkel was probably worried before the meeting that too few countries would sign up (there was talk of only a hard core of countries proceeding), now she is surely concerned by the fact that so many have. In many ways the biggest weakness of her debt brake proposal is that it has become "too successful" to be fully credible.

A Continent Which Has Isolated Itself From The British Isles?

That British "separatism" has again raised its ugly head should not be surprising, since this issue has a long history (as I was only too clearly reminded yesterday when the local TV news here in Catalonia ran footage of General de Gaulle warning that allowing the UK to enter the common market would be a major strategic mistake and a significant setback for the European construction process), but the water in which all this discourse flows is now so mirky that it is hard to separate what is really relevant to the point at issue, and what isn't.

In fact France, Germany and the UK should have reached agreement before the summit even started, and the agreement should have been restricted to measures which were considered necessary to resolving the Euro debt crisis, including the rules and institutions which are lacking. Maybe it is a pity that these three countries have to have such a decisive role in European decision making, but for better or worse that is the way it is.

Now the UK has exercised its veto, and we have a legal mess. According to Peter Spiegel writing in the Financial Times, Britain’s rejection of treaty changes means that the other 26 EU members will now have to jerry-rig an intergovernmental system without the automatic right to use the EU’s institutions, leaving decisions taken vulnerable to continuing legal challenge. As a result financial market participants will have one more reason to doubt the new fiscal pact’s viability and credibility.

If the European Union's institutional maze was already proving hard for investors and external policy makers to follow, this latest twist in events will hardly make it easier for them.

This is an outcome that should have been avoided at all costs, and indeed I think the most intelligent thing the three of them could do now would be to meet again and find a solution to the real problem at hand before the euro finally blows itself apart, with highly undesireable consequences for all of us.

People say that the EU was created to ensure there were no more wars in Europe but personally I think a West European centred WWIII was never a very likely eventuality. In any event the EU could have been set up with a much more limited objective, namely to end periodic outbreaks of tribalism and jingoisim. This is the real European curse, and this is what we are now facing in one country after another, as - with the local national press in the vanguard - each blames the other for causing the crisis, or for not reaching the much needed agreement to end it. The sad reality is that Europe's leaders fiddle even as Rome is about to burn.

Save The Euro!

The nub of the question is the Euro, and setting up some form of workable common governance for those countries who belong to the monetary union. In this sense an agreement between the 17 countries who share the common currency would have made perfect sense, and in is not clear to me at least why the UK (or countries like Bulgaria and Romania for that matter) would need to be party to this kind of agreement. But, it seems, representatives of the EU Commission and the German and French governments have been so concerned to identifty saving the Euro with the idea of saving Europe that this important point of detail seems to have gotten buried well down in the pile of paperwork.

Countries like the UK, Sweden and Denmark do not use the Euro since they decided not to do so. Countries like Latvia and Lithuania do not use it since they were not allowed to, and the EU even refused a 2008 request from the IMF to allow Latvia to devalue and enter the currency area at a moment when that country was indeed in a situation of most urgent need.

What the latest tiff underlines more than anything else is the way we are lacking a coherent and consistent account of what the relationship between the EU and the Euro is, and this is not something which has only been discovered yesterday. Maybe the seeds of what happened last Friday are the result of having the Euro regulations form part of the EU Treaty itself, rather than being an agreement between a more limited group of countries in the manner that is now being proposed. Again, if the Euro was to form one of the indispensible parts of the EU Treaty, in many ways it didn't make sense to allow the East European members to join until the had fulfilled the Maastricht criteria for Euro membership.

Viewed in this light, last Friday's events were always a problem which was waiting to happen.

It may well be that the Euro was created as a stepping stone towards a form of political union that not all member countries wanted, but now we are apparently seeing a sort of fait accompli shotgun wedding, since without such an enhanced union, not only may the currency itslef fall apart, but entire global financial system, and everything we know and love seems likely to be carried away with it. I'm not sure whether or not this constitutes moral hazard, but it sure as hell constitutes a pretty potent form of moral blackmail.

Fiscal Pact or Fiscal Union?

Then again, what Europe's leaders were talking about last Friday was not just any old kind of political union. Despite all the talk about creating the groundwork for fiscal union (it will be remembered that one of the commonly cited differences between the dollar and the euro as common currencies is that all states in the American Union are backed by the US Treasury, while the world still waits to learn who - or what - is backing the individual states in the European one). What we we are being offered is not a common treasury of the kind which would convince markets that there was something solid standing behind the currency, but rather what Wolfgang Munchau recently referred to as "another one of those Silly growth and Stability Pacts".

Doing The Berlin Brake Dance

What Wolfgang is getting at here is that the core of the proposed EU agreement is the introduction of the so called "balanced budget amendment" as a binding principle across all the eventual signitaries. Naturally Germany already has this amendment in place. According to Wikipedia: "In 2009 Germany's constitution was amended to introduce the Schuldenbremse ("debt brake"), a balanced budget provision. This will apply to both the federal government and the Länder (states). From 2016 onwards the federal government will be forbidden to run a deficit of more than 0.35% of GDP. From 2020, the states will not be permitted to run any deficit at all. The Basic Law permits an exception to be made for emergencies such as a natural disaster or severe economic crisis".

This is the role model for the kind of constitutional amendment other states will now be expected to introduce - as the Economist wryly notes perhaps Schuldenbremse will one day form part of the French and Italian languages in the same way “kindergarten” has become part of the English one.

The 0.35% deficit permitted is in fact a form of what is termed "structural deficit", that is to say there is a formula according to which it can be averaged out over the economic cycle, although even after allowing for this the deficit number is not going to be that high, and in any event at no point should the deficit exceed 3% of GDP.

More important even than this deficit restriction, however, is the so called debt brake principle, which implies countries must steadily reduce their debt to 60% of GDP over a specified time period. If, as may be anticipated, growth and inflation in the Euro Area is going to be low, then effectively countries will not be running deficits at all, but rather surpluses, depending on how much over 60% they will be when the present crisis comes to an end, and what the time scale for reduction eventually is. As far as I can see the current proposal for the new pact coming from the finance ministers (Ecofin) is that from 2013 countries reduce the part of the debt which is over 60% of GDP by 1/20 per annum.

At the end of the day one thing is clear, and this has not been emphasised enough in the press reporting of the summit, this is the end of Keynesian demand management as a policy tool as it has been practised in Europe since the end of WWII. That is to say, while it is be one thing to argue that simply creating more debt through fiscal policy may not be the most appropriate way to solve a crisis which has been caused by excessive indebtedness, it is going a bridge further to suggest that counter cyclical fiscal policy should not be practised. Germany's leaders have, it seems, crossed that bridge. Naturally not all German economists agree. As the Economist reports Peter Bofinger, one of five economic “wise men” who advise the German government, is one of them. On a normal Keynesian view, the balanced budget ammendment could choke-off economic recoveries - some would argue Germany's commitment to this principle at this point is an example of this issue. Having a structural component in the target target allows deficits to rise slightly when output falls below trend with the additional deficit being offset by surpluses during upswings. But, as Bofinger argues, this “assumes textbook-like economic cycles,” and garden variety recession. In the real world cycles and crises vary. An externally induced recession followed by a weak recovery can excessively reduce potential growth, while the balanced budget restriction would restrict the deficit spending needed to stimulate demand.

Given the magnitude of these issues, it is surprising how little debate the proposal is generating, and of course it is hard not to be struck by how quickly people who obviously would not have understood what was really involved were to arrive in Brussels and offer to sign on the ditted line without too much attention to the small print. The exact detailing of the amendment varies - in Spain for example the limit is 0.4% of GDP for the deficit, and the limit is operationalised in 2020. In addition the Spanish wording is also interestingly different from the German version, since it stipulates that the limit can only be exceeded in the event of "natural disaster, economic recession or other extraordinary circumstances". This substitutes the wording "economic recession" for the German "severe economic crisis" variant, which really rather than concealing any sinister intention suggests to me more than anything that the Spanish parliament didn't understand what they were voting for, since the idea is (as I say) for structural deficit over the cycle, and "cycle" obviously includes recession, so a mere recession cannot be an exception, though what counts as "severe" in the German case doubtless awaits interpreting in the courts.

Here Comes My Nineteenth Nervous Brake-down

Once more the Economist gets the basic point:

There is an imbalance in voting intentions between countries. Angela Merkel is marking out a very long term agenda:"This is a breakthrough to a union of stability," Reuters cite her as saying. "We will use the crisis as a chance for a new beginning." It is hard to see why countries like Romania and Bulgaria with a very poor institutional record are in such a hurry to sign up to this without a lot more reflection. The use of the word "stability" is very important. Merkel is prioritising sustainability and stability in the longer run over short term growth. This is very consistent with a whole German view of things and completely in harmony with the ecological strain of thought in the modern German world view. I have a lot of respect for this (even where I disagree), and especially for the fact that someone in Europe is trying to think in the longer term. But I cannot help feeling many of the people and countries voting for the new agreement were only thinking about their financing needs in the short term, and were not fully cognisant of the fact that they were voting for a new beginining, a new type of Europe, where living standards may be lower, but the debt dynamics will be more stable. Personally I can only make sense of this in terms of Europe's current demographics, and the challenge that is represented by maintaining health and pension systems in the face of low growth and ageing and declining workforces.

Each Unhappy Family Is Unhappy In Its Own Way

Hence perhaps the most worrying thing about last weeks agreement to agree was that each and every one of the 26 countries concerned has stated that "I will stop beating my wife, I promise I will, and soon", but understands what this means in their own special way. Despite the fact that Germany has been quite clear, for example, the much respected Mario Monti is sure that Euro Bonds are almost within reach.

Thus many of those who were eagerly struggling to be first to sign on the dotted line last Friday didn't get the gist of the point of what they were signing up to, and the agreement will only really be adding to credibility once it is tried and tested. In the meantime everyone is simply following the lead given by Mario Monti, and assuming that what is actually going on isn't the death of Keynes, but the birth of German funded Eurobonds.

Land Ahoy!

But, having said all this, let's go back to where we started, to the isolation of the UK within the European Union. Could it be, as Philip Stevens suggests in an opinion piece in the Financial Times, that the UK is on its way out of the EU? As he says, it all depends on which end of the telescope you look down. Viewed from one one end, Mr Cameron’s veto was the moment Britain signalled the beginning of a long goodbye to Europe; looked at through the other it was Europe bidding its farewell to Britain. But are we sure, even Stephens has his doubts:

Possibly this is so, but given the difficulties presented by having to take this agreement forward outside the formal structure of the EU, it is hard to not reach the conclusion that both Angela Merkel and Nicolas Sarkozy have been guilty if not of a similar blunder, then at least a major error of judgement. On the other hand the issues involved in the proposed new arrangements are highly complex and in some senses ground breaking, so it is indeed suprprising that so many (and so diverse) countries were able to reach such rapid agreement on the need for and the broad outlines of a new agreement. While Angela Merkel was probably worried before the meeting that too few countries would sign up (there was talk of only a hard core of countries proceeding), now she is surely concerned by the fact that so many have. In many ways the biggest weakness of her debt brake proposal is that it has become "too successful" to be fully credible.

A Continent Which Has Isolated Itself From The British Isles?

That British "separatism" has again raised its ugly head should not be surprising, since this issue has a long history (as I was only too clearly reminded yesterday when the local TV news here in Catalonia ran footage of General de Gaulle warning that allowing the UK to enter the common market would be a major strategic mistake and a significant setback for the European construction process), but the water in which all this discourse flows is now so mirky that it is hard to separate what is really relevant to the point at issue, and what isn't.

In fact France, Germany and the UK should have reached agreement before the summit even started, and the agreement should have been restricted to measures which were considered necessary to resolving the Euro debt crisis, including the rules and institutions which are lacking. Maybe it is a pity that these three countries have to have such a decisive role in European decision making, but for better or worse that is the way it is.

Now the UK has exercised its veto, and we have a legal mess. According to Peter Spiegel writing in the Financial Times, Britain’s rejection of treaty changes means that the other 26 EU members will now have to jerry-rig an intergovernmental system without the automatic right to use the EU’s institutions, leaving decisions taken vulnerable to continuing legal challenge. As a result financial market participants will have one more reason to doubt the new fiscal pact’s viability and credibility.

"The arcane issue of whether a group of countries acting outside the EU’s treaties can use the European Commission, with its surveillance and enforcement powers, and the European Court of Justice, has been pushed to the forefront of the eurozone debt crisis. Britain, which refused to sign up to a treaty, but does not wish to see itself sidelined altogether, insists that its 26 EU partners must do without the European institutions".

If the European Union's institutional maze was already proving hard for investors and external policy makers to follow, this latest twist in events will hardly make it easier for them.

This is an outcome that should have been avoided at all costs, and indeed I think the most intelligent thing the three of them could do now would be to meet again and find a solution to the real problem at hand before the euro finally blows itself apart, with highly undesireable consequences for all of us.

People say that the EU was created to ensure there were no more wars in Europe but personally I think a West European centred WWIII was never a very likely eventuality. In any event the EU could have been set up with a much more limited objective, namely to end periodic outbreaks of tribalism and jingoisim. This is the real European curse, and this is what we are now facing in one country after another, as - with the local national press in the vanguard - each blames the other for causing the crisis, or for not reaching the much needed agreement to end it. The sad reality is that Europe's leaders fiddle even as Rome is about to burn.

Save The Euro!

The nub of the question is the Euro, and setting up some form of workable common governance for those countries who belong to the monetary union. In this sense an agreement between the 17 countries who share the common currency would have made perfect sense, and in is not clear to me at least why the UK (or countries like Bulgaria and Romania for that matter) would need to be party to this kind of agreement. But, it seems, representatives of the EU Commission and the German and French governments have been so concerned to identifty saving the Euro with the idea of saving Europe that this important point of detail seems to have gotten buried well down in the pile of paperwork.

Countries like the UK, Sweden and Denmark do not use the Euro since they decided not to do so. Countries like Latvia and Lithuania do not use it since they were not allowed to, and the EU even refused a 2008 request from the IMF to allow Latvia to devalue and enter the currency area at a moment when that country was indeed in a situation of most urgent need.

What the latest tiff underlines more than anything else is the way we are lacking a coherent and consistent account of what the relationship between the EU and the Euro is, and this is not something which has only been discovered yesterday. Maybe the seeds of what happened last Friday are the result of having the Euro regulations form part of the EU Treaty itself, rather than being an agreement between a more limited group of countries in the manner that is now being proposed. Again, if the Euro was to form one of the indispensible parts of the EU Treaty, in many ways it didn't make sense to allow the East European members to join until the had fulfilled the Maastricht criteria for Euro membership.

Viewed in this light, last Friday's events were always a problem which was waiting to happen.

It may well be that the Euro was created as a stepping stone towards a form of political union that not all member countries wanted, but now we are apparently seeing a sort of fait accompli shotgun wedding, since without such an enhanced union, not only may the currency itslef fall apart, but entire global financial system, and everything we know and love seems likely to be carried away with it. I'm not sure whether or not this constitutes moral hazard, but it sure as hell constitutes a pretty potent form of moral blackmail.

Fiscal Pact or Fiscal Union?

Then again, what Europe's leaders were talking about last Friday was not just any old kind of political union. Despite all the talk about creating the groundwork for fiscal union (it will be remembered that one of the commonly cited differences between the dollar and the euro as common currencies is that all states in the American Union are backed by the US Treasury, while the world still waits to learn who - or what - is backing the individual states in the European one). What we we are being offered is not a common treasury of the kind which would convince markets that there was something solid standing behind the currency, but rather what Wolfgang Munchau recently referred to as "another one of those Silly growth and Stability Pacts".

"Contrary to what is being reported, Ms Merkel is not proposing a fiscal union. She is proposing an austerity club, a stability pact on steroids. The goal is to enforce life-long austerity, with balanced budget rules enshrined in every national constitution. She also proposes automatic sanctions with a judicially administered regime of compliance".

Doing The Berlin Brake Dance

What Wolfgang is getting at here is that the core of the proposed EU agreement is the introduction of the so called "balanced budget amendment" as a binding principle across all the eventual signitaries. Naturally Germany already has this amendment in place. According to Wikipedia: "In 2009 Germany's constitution was amended to introduce the Schuldenbremse ("debt brake"), a balanced budget provision. This will apply to both the federal government and the Länder (states). From 2016 onwards the federal government will be forbidden to run a deficit of more than 0.35% of GDP. From 2020, the states will not be permitted to run any deficit at all. The Basic Law permits an exception to be made for emergencies such as a natural disaster or severe economic crisis".

This is the role model for the kind of constitutional amendment other states will now be expected to introduce - as the Economist wryly notes perhaps Schuldenbremse will one day form part of the French and Italian languages in the same way “kindergarten” has become part of the English one.

The 0.35% deficit permitted is in fact a form of what is termed "structural deficit", that is to say there is a formula according to which it can be averaged out over the economic cycle, although even after allowing for this the deficit number is not going to be that high, and in any event at no point should the deficit exceed 3% of GDP.

More important even than this deficit restriction, however, is the so called debt brake principle, which implies countries must steadily reduce their debt to 60% of GDP over a specified time period. If, as may be anticipated, growth and inflation in the Euro Area is going to be low, then effectively countries will not be running deficits at all, but rather surpluses, depending on how much over 60% they will be when the present crisis comes to an end, and what the time scale for reduction eventually is. As far as I can see the current proposal for the new pact coming from the finance ministers (Ecofin) is that from 2013 countries reduce the part of the debt which is over 60% of GDP by 1/20 per annum.

At the end of the day one thing is clear, and this has not been emphasised enough in the press reporting of the summit, this is the end of Keynesian demand management as a policy tool as it has been practised in Europe since the end of WWII. That is to say, while it is be one thing to argue that simply creating more debt through fiscal policy may not be the most appropriate way to solve a crisis which has been caused by excessive indebtedness, it is going a bridge further to suggest that counter cyclical fiscal policy should not be practised. Germany's leaders have, it seems, crossed that bridge. Naturally not all German economists agree. As the Economist reports Peter Bofinger, one of five economic “wise men” who advise the German government, is one of them. On a normal Keynesian view, the balanced budget ammendment could choke-off economic recoveries - some would argue Germany's commitment to this principle at this point is an example of this issue. Having a structural component in the target target allows deficits to rise slightly when output falls below trend with the additional deficit being offset by surpluses during upswings. But, as Bofinger argues, this “assumes textbook-like economic cycles,” and garden variety recession. In the real world cycles and crises vary. An externally induced recession followed by a weak recovery can excessively reduce potential growth, while the balanced budget restriction would restrict the deficit spending needed to stimulate demand.

Given the magnitude of these issues, it is surprising how little debate the proposal is generating, and of course it is hard not to be struck by how quickly people who obviously would not have understood what was really involved were to arrive in Brussels and offer to sign on the ditted line without too much attention to the small print. The exact detailing of the amendment varies - in Spain for example the limit is 0.4% of GDP for the deficit, and the limit is operationalised in 2020. In addition the Spanish wording is also interestingly different from the German version, since it stipulates that the limit can only be exceeded in the event of "natural disaster, economic recession or other extraordinary circumstances". This substitutes the wording "economic recession" for the German "severe economic crisis" variant, which really rather than concealing any sinister intention suggests to me more than anything that the Spanish parliament didn't understand what they were voting for, since the idea is (as I say) for structural deficit over the cycle, and "cycle" obviously includes recession, so a mere recession cannot be an exception, though what counts as "severe" in the German case doubtless awaits interpreting in the courts.

Here Comes My Nineteenth Nervous Brake-down

Once more the Economist gets the basic point:

"Germany has yet to put its debt brake to the test. The federal government made things easier for itself by a generous calculation of last year’s structural deficit, which is to be cut in equal annual steps to reach the 2016 target. Flush with cash, thanks to a strong economy, it has found room for giveaways to voters without falling foul of the brake. Civil servants will get a bigger Christmas bonus next year, for example. For the Länder, the 2020 deadline seems a long way off: 13 of them budgeted for increases in structural deficits this year, laments a study by RWI Essen, a research institute. A “stability council”, composed of federal and state ministers, has little power to sanction prodigals. Apparently, it is as toothless as the enforcers of European financial discipline".

There is an imbalance in voting intentions between countries. Angela Merkel is marking out a very long term agenda:"This is a breakthrough to a union of stability," Reuters cite her as saying. "We will use the crisis as a chance for a new beginning." It is hard to see why countries like Romania and Bulgaria with a very poor institutional record are in such a hurry to sign up to this without a lot more reflection. The use of the word "stability" is very important. Merkel is prioritising sustainability and stability in the longer run over short term growth. This is very consistent with a whole German view of things and completely in harmony with the ecological strain of thought in the modern German world view. I have a lot of respect for this (even where I disagree), and especially for the fact that someone in Europe is trying to think in the longer term. But I cannot help feeling many of the people and countries voting for the new agreement were only thinking about their financing needs in the short term, and were not fully cognisant of the fact that they were voting for a new beginining, a new type of Europe, where living standards may be lower, but the debt dynamics will be more stable. Personally I can only make sense of this in terms of Europe's current demographics, and the challenge that is represented by maintaining health and pension systems in the face of low growth and ageing and declining workforces.

Each Unhappy Family Is Unhappy In Its Own Way

Hence perhaps the most worrying thing about last weeks agreement to agree was that each and every one of the 26 countries concerned has stated that "I will stop beating my wife, I promise I will, and soon", but understands what this means in their own special way. Despite the fact that Germany has been quite clear, for example, the much respected Mario Monti is sure that Euro Bonds are almost within reach.

"Italian Prime Minister Mario Monti said Germany and other countries will eventually be convinced that commonly issued euro zone bonds are a useful way of tackling the region's debt crisis. "I believe we have enough arguments to convince the Germans," Monti told Euronews in a television interview". He also is still pushing to have the funding capacity of the EFSF increased, again as if the German parliament had not voted to put a ceiling on the level of its exposure. "Monti said he regretted that European leaders had not agreed to increase the European bailout fund (EFSF) by more than 500 billion euros ($668.25 billion) at last week's meeting in Brussels. A more substantial firewall would have been a better guarantee against market tensions, he said, adding this had been blocked by several European countries that "have a very limited view of what is the common interest".The worrying thing is not only that Mario Monti believes this but, more importantly, that this is probably what he is telling the Italian electorate, leaving them with a very limited understanding of the kind of sacrifices they are actually going to be ask to accept. Last week's round of 2012 austerity measures will be as nothing when compared with those that would really be required to get Italian debt back down to 60% of GDP.

Thus many of those who were eagerly struggling to be first to sign on the dotted line last Friday didn't get the gist of the point of what they were signing up to, and the agreement will only really be adding to credibility once it is tried and tested. In the meantime everyone is simply following the lead given by Mario Monti, and assuming that what is actually going on isn't the death of Keynes, but the birth of German funded Eurobonds.

Land Ahoy!

But, having said all this, let's go back to where we started, to the isolation of the UK within the European Union. Could it be, as Philip Stevens suggests in an opinion piece in the Financial Times, that the UK is on its way out of the EU? As he says, it all depends on which end of the telescope you look down. Viewed from one one end, Mr Cameron’s veto was the moment Britain signalled the beginning of a long goodbye to Europe; looked at through the other it was Europe bidding its farewell to Britain. But are we sure, even Stephens has his doubts:

"It is important to insert a caveat here. The presumption of everyone in the room in Brussels was that the eurozone countries will indeed succeed in saving the single currency and build alongside it a more integrated political union. That enterprise could yet fail. Some will say after the limited progress made at the summit on rescue plan, the odds have now stacked against the euro. If it were to fall apart, so too would all other ambitions among the 17 eurogroup members".So advertently or inadvertently David Cameron now has a Euro put. If the Euro survives his fate is sealed, in the most negative of senses, yet if it fails, then not only will he have been proved right, he may also find himself having to assume the mantle of leadership (backbench eurosceptics and all) and instill in a European Union in complete disorder the kind of Dunkirk Spirit for which the islands from which he hails have made themselves famous. And while we are on the question of survival, perhaps it would be to the point to close with John Authers assesment of the state of play in the argument.

Amid all the heated speculation about the European Union summit’s impact on Europe’s economic future and Britain’s role in it, traders are asking a more mundane question: “Has it done enough to get us through to Christmas?” Their answer: probably not. The muted market moves on Friday may be misleading. The euro rose against the dollar – but this may have been driven by banks repatriating assets. European bank shares, while above their lows, trade at half their book value, implying grave fears that some of their assets will be written down. The yield on Italy’s 10-year government bond fell 30 basis points during the day to 6.32 per cent – but this is still higher than at any point in the eurozone’s history until a month ago. The risk remains that the market will test Mr Draghi’s resolve by attacking a peripheral country’s debt in the two weeks before Christmas – particularly if a rating agency provides an excuse.Amen to that! This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Sunday, November 27, 2011

Last Days Of Pompeii?

This week we got what seemed to be some good news in the ongoing Euro debt crisis. Bond spreads in many of the countries on Europe's periphery tightened vis-their German equivalents. Unfortunately we also got some bad news to go with it (no silver lining these days without the accompanying black cloud it seems): the tighter spreads were the result of a weakening of German bunds (or a rise in their yields) following what many considered to be a failed bond auction.

What is becoming clearer to almost everyone is that this is now no longer simply a Euro periphery sovereign debt crisis. It has become a full blown crisis of confidence in the Euro itself.

But just in case anyone was in any doubt, this week Deutsche Bank Chief Economist Thomas Mayer said as much on Bloomberg TV. Naturally he is far from the first to make this point - Commission President José Barroso and European Council President Herman Von Rompuy have been stressing the point for some time now - but it is an interesting reflection of how widely this opinion is now spreading.

One of the reasons for the recent rise in tone and in the level of concern is that it is clear contagion is now spreading far from the periphery. Belgium and French bonds have come under increasing presssure. And, of course, that famous German bond auction seems to suggest that even German yields are not immune to contamination. Actually, one unsuccesful German bond auction doesn't make a season of them, and Germany is well able to finance itself, but obviously markets are now drawing the conclusion that if Germany isn't willing or able to cut loose from the sinking economies on the periphery, then the German economy will eventually be dragged down with them, which means that German bunds are no longer seen as a surrogate Deutsche Mark, but rather as the backstop for all the unfunded periphery losses which might show up on the EU desk.

Of course, this weekend there has been a huge rush to agree a budget and put together a government, but after seven months of dawdling as if the large sovereign debt the country is labouring under wasn't a problem all these last minute efforts somehow fail to convince. Really it is the whole European model of nation states and national identities which lie behind the common currency that often lie at the heart of the problem. If countries like Belgium lack a national consensus, while others like Italy and Spain have minorities (who pay more than there numerical share) who are not really convinced they want to be in the country, then how can a fiscal union which would be based on some countries permanently paying (the so called transfer union) while others continually receive hope to hold itself together politically?

Then the possibility of joint and several responsibilities between an ever diminishing number of "core" core countries is simply leading to impossible pressures on the sovereign debt of the countries concerned. We have seen the first jitters in the direction of German debt this week, but France is a much clearer example as the exposure of the French banking system to Italy (400 billion euros worth, including public and private sector debt, according to BIS data) is leading to impossible pressure accumulating over the French rating, something which makes activating the EFSF as initially intended look increasingly difficult.

And contagion from the crisis is now heading East. Austria is worried about its triple A, and is imposing new restriction on CEE funding by Austrian Banks. Naturally, as Fitch suggest, this is likely to extend the credit crunch out to the East.

Hungary is the obvious "missing link" here.

In fact, far from having the "V shaped" recovery from the Tsunami some (not me) were predicting the short term outlook for the economy seems pretty dire. Policymakers in Japan still attempt to pin the problems down to confidence issues stemming from the Euro debt crisis and the high value of the yen, but surely what has been happening in Japan over the last 20 years has something more than local interest, since it was a harbinger of things to come elsewhere.

The Present Crisis Is Generalised One, Effectively Facing All Developed Economies

In the first place there is the problem of debt (whether public or private).

Cutting through all the foam and wrapping here, the key question is who is going to sign the cheques and who is going to pay? José Barroso and Herman Van Rompuy may make very nice photo images in Washington, but what exactly does there bank balance look like? So the key question market participants want to know, as President Barack Obama asked in Canberra recently, is who (or what) really stands behind the Euro. The answer so far has simply been a deafening silence.

So what are the institutional solutions that are being toyed around with? The basic point to get is that this is all about money, who is to provide it, and who will take any losses there may be in the longer term. Basically there are three lines of attack on the table.

a) The ECB

b) The EFSF

c) Eurobands

In fact the solution Europe's leaders are likely to come up with involves some variant of all of these. As I suggested in my last piece, the ECB is desparate to go so far and no further. This is understandable given that no central bank likes the idea of finding itself having to show losses. Just how far the bank is prepared to go in order to avoid this is made plain from the rumour circulating this weekend that the IMF was readying up 600 billion Euros to lend to Italy. Just where the IMF was going to find the money was not explained by most of the sources, but thanks to a speedy translation from Edward Harrison at Credit Writedowns, we discover that it was another one of those cockamany schemes whereby the ECB would actually lend the money, but the IMF would guarantee all the risk. Which simply begs the question; is there no one in Europe willing and able to guarantee the risk? And if not, why not? A stunning silence from Berlin.

Under the circumstances it is hardly suprising that the IMF rapidly denied the report. It looks to me like someone, somewhere (someone with responsibilities for funding the IMF perhaps?) put their foot down, and firmly.

Nonetheless it is quite likely that the ECB would be involved in some way, shape or form in any final attempt to rescue the Euro, possibly via some kind of security markets programme, and keeping the banking system supplied with liquidity.

Which brings us to the EFSF, and here we do have some news. According to a report from Reuters, the documentation is all ready and prepared for the EU Finance Ministers meeting tomorrow on formulas for leveraging the EFSF.

Most observers have reached the conclusion that such bonds will at some point form part of Eurozone policy, but how, and when? The problem is that Angela Merkel is widely perceived as holding back in order to put pressure on recalcitrant periphery governments to bring their deficits into line. But you can only take brinksmanship so far before you risk having things blow up in your face, a point which is very well illustrated by the dilemmas facing Mario Monti's new government. The problem is the timescale of debt reduction is one thing, and that of market confidence another.

Germany is insisting that any advance towards Eurobonds is dependent on moves to what Angela Merkel calls a fiscal union. But by this she doesn't mean the type of common treasury they have in the US, where stronger states help the weaker ones, what she means is common fiscal discipline, with powers from the centre to enforce.

The only thing that can be said with any certainty about this situation is that it is very confused. One leaked proposal follows after another, while representatives of the EU Commission in Brussels can barely conceal their frustration with the "go it alone" approach being promoted in Paris and Berlin. Matters reached a head today with an article in the German newspaper Die Welt (allegedly based on a leak) asserting that Germany was preparing to issue "top tier" Eurobonds with a select group of other triple A countries.

This could be read as a first step to a two tier Euro, which would at least be a step towards something. But it is too early to answer the question of whether it is, or whether it isn't.

Readying Up For The Transition

In the meantime market participants are walking with their feet. Both banks and ratings agencies are sounding their loudest warnings yet that the euro area risks unraveling unless those responsible for decision taking intensify their efforts to stop the rot.

Just this morning I got a research report from Mehernosh Engineerand Gregory Venizelos of the PNB Paribas European Credit Research team.in which they argue that capital flight is already effectively taking place.

On the other hand Citi's European Research Team are on "deposit watch", and claim to see signs of deposit outflows from periphery to "core", not retail deposits but corporate ones.

Meanwhile over at Nomura they are already speculating on how assets will be denominated after break up:

and giving advice to clients on the legal ins and outs of asset redenomination. Closing time in the gardens of the west anyone?

In this environment, it is hardly surprising that Wolfgang Munchau was his usual cheerful self in the FT this morning.

While perennial optimist Paul Krugman puts the situation really quite succinctly on his blog.

What is becoming clearer to almost everyone is that this is now no longer simply a Euro periphery sovereign debt crisis. It has become a full blown crisis of confidence in the Euro itself.

But just in case anyone was in any doubt, this week Deutsche Bank Chief Economist Thomas Mayer said as much on Bloomberg TV. Naturally he is far from the first to make this point - Commission President José Barroso and European Council President Herman Von Rompuy have been stressing the point for some time now - but it is an interesting reflection of how widely this opinion is now spreading.

One of the reasons for the recent rise in tone and in the level of concern is that it is clear contagion is now spreading far from the periphery. Belgium and French bonds have come under increasing presssure. And, of course, that famous German bond auction seems to suggest that even German yields are not immune to contamination. Actually, one unsuccesful German bond auction doesn't make a season of them, and Germany is well able to finance itself, but obviously markets are now drawing the conclusion that if Germany isn't willing or able to cut loose from the sinking economies on the periphery, then the German economy will eventually be dragged down with them, which means that German bunds are no longer seen as a surrogate Deutsche Mark, but rather as the backstop for all the unfunded periphery losses which might show up on the EU desk.

The frontier between core and periphery is becoming increasingly blurred, with Belgian borrowing costs hitting a Euro era high of 5.8% last Friday.

Of course, this weekend there has been a huge rush to agree a budget and put together a government, but after seven months of dawdling as if the large sovereign debt the country is labouring under wasn't a problem all these last minute efforts somehow fail to convince. Really it is the whole European model of nation states and national identities which lie behind the common currency that often lie at the heart of the problem. If countries like Belgium lack a national consensus, while others like Italy and Spain have minorities (who pay more than there numerical share) who are not really convinced they want to be in the country, then how can a fiscal union which would be based on some countries permanently paying (the so called transfer union) while others continually receive hope to hold itself together politically?

Then the possibility of joint and several responsibilities between an ever diminishing number of "core" core countries is simply leading to impossible pressures on the sovereign debt of the countries concerned. We have seen the first jitters in the direction of German debt this week, but France is a much clearer example as the exposure of the French banking system to Italy (400 billion euros worth, including public and private sector debt, according to BIS data) is leading to impossible pressure accumulating over the French rating, something which makes activating the EFSF as initially intended look increasingly difficult.

And contagion from the crisis is now heading East. Austria is worried about its triple A, and is imposing new restriction on CEE funding by Austrian Banks. Naturally, as Fitch suggest, this is likely to extend the credit crunch out to the East.

Hungary is the obvious "missing link" here.

But Romania is evidently not far behind, and President Traian Basescu is definitely not amused.

Of course the problem is not just a European one. Japan has a massive sovereign debt problem too.

In fact, far from having the "V shaped" recovery from the Tsunami some (not me) were predicting the short term outlook for the economy seems pretty dire. Policymakers in Japan still attempt to pin the problems down to confidence issues stemming from the Euro debt crisis and the high value of the yen, but surely what has been happening in Japan over the last 20 years has something more than local interest, since it was a harbinger of things to come elsewhere.

Secondly there is the problem of population ageing. The figures below show the transformation in Italy's population pyramid between 1970 and 2030. In many ways Italy's demography was at the most favourable point for economic growth (supply side) around 1990 (third figure top row) since the proportion of the total population in the working age group was at near its maximum, and the median age of the workforce was still relatively low. The point to get is that it isn't simply the level of debt that is the problem, it is the level of debt in the context of the implicit liabilities (in terms of health and pensions) which such population ageing represents, and the reduced growth outlook that having declining and ageing populations represents. Europe's leaders are essentially in denial on the extent of this problem, and are putting all their eggs in the "structural reforms to raise trend growth" basket.

The third factor which has decisively changed things to the disadvantage of the ageing and endebted developed economies has been the rise of the new emerging economies. This has changed the perception of risk, against developed economies and in favour of emerging ones. It is unlikely that this trend will be reversed. So we have economies with excessive debt plus implicit liabilities who are going to be challenged to sustain growth rates similar in magnitude to those we have observed in the recent past, and it is this which makes the level of accumulated debt unustainable and which makes it possible to speak of a developed world generalised debt crisis.

But, despite this, those countries in the Euro area have a special problem. The common currency was created with a deficient institutional structure, which creates confusion over who is responsible for what. Viewed from outside the EU it almost seems as if you need a PhD in European studies to follow what is going on. In an era where the best policy if you have a financial product to take to market is "keep it simple" this hardly would seem to be a good idea.

So what are the institutional solutions that are being toyed around with? The basic point to get is that this is all about money, who is to provide it, and who will take any losses there may be in the longer term. Basically there are three lines of attack on the table.

a) The ECB

b) The EFSF

c) Eurobands

In fact the solution Europe's leaders are likely to come up with involves some variant of all of these. As I suggested in my last piece, the ECB is desparate to go so far and no further. This is understandable given that no central bank likes the idea of finding itself having to show losses. Just how far the bank is prepared to go in order to avoid this is made plain from the rumour circulating this weekend that the IMF was readying up 600 billion Euros to lend to Italy. Just where the IMF was going to find the money was not explained by most of the sources, but thanks to a speedy translation from Edward Harrison at Credit Writedowns, we discover that it was another one of those cockamany schemes whereby the ECB would actually lend the money, but the IMF would guarantee all the risk. Which simply begs the question; is there no one in Europe willing and able to guarantee the risk? And if not, why not? A stunning silence from Berlin.

Nonetheless it is quite likely that the ECB would be involved in some way, shape or form in any final attempt to rescue the Euro, possibly via some kind of security markets programme, and keeping the banking system supplied with liquidity.

Which brings us to the EFSF, and here we do have some news. According to a report from Reuters, the documentation is all ready and prepared for the EU Finance Ministers meeting tomorrow on formulas for leveraging the EFSF.

The formula being used for leveraging makes the current proposal look very similar to original Alianz Insurance proposal. The documents seen by Reuters specify that the EFSF could offer partial protection to investors buying a country's bonds at a primary auction of around 20-30 percent of the principal amount of the bond, depending on market circumstances.The protection certificate would be detachable from the bond and could be traded separately, but the investor would have to hold bonds of the country before cashing it in. The certificate could be paid if the bond issuer triggers a credit event under the full definition of the International Swaps and Derivatives Association, but, of course, in the wake of the Greek private sector involvement swap investors are now nervous that any future restructuring of Eurozone bonds might be carried out in such a way as to not trigger an ISDA event, so it is not really clear how valuable this insurance actually is, or how it will be perceived by investors.

But this isn't the sum total of the problems faced by the EFSF approach, since according to CEO Klaus Regling, the original levaraging objective is now no longer attainable, due to the loss of market confidence. And with Italy alone rumoured to be looking for something like 600 billion Euros, the doable quantities from the EFSF now fall far short of what will be needed.

Which brings us back to Eurobonds, which must be the last ditch recourse of someone or other. Markets certainly pricked up their ears last week when Angela Merkel issued those famous "now for now" words, but since that time we have simply had confusion. Actually the latest proposal on the bonds have come from the commission rather than the Paris-Berlin axis.

Germany is insisting that any advance towards Eurobonds is dependent on moves to what Angela Merkel calls a fiscal union. But by this she doesn't mean the type of common treasury they have in the US, where stronger states help the weaker ones, what she means is common fiscal discipline, with powers from the centre to enforce.

The only thing that can be said with any certainty about this situation is that it is very confused. One leaked proposal follows after another, while representatives of the EU Commission in Brussels can barely conceal their frustration with the "go it alone" approach being promoted in Paris and Berlin. Matters reached a head today with an article in the German newspaper Die Welt (allegedly based on a leak) asserting that Germany was preparing to issue "top tier" Eurobonds with a select group of other triple A countries.

This could be read as a first step to a two tier Euro, which would at least be a step towards something. But it is too early to answer the question of whether it is, or whether it isn't.

Readying Up For The Transition

In the meantime market participants are walking with their feet. Both banks and ratings agencies are sounding their loudest warnings yet that the euro area risks unraveling unless those responsible for decision taking intensify their efforts to stop the rot.

Just this morning I got a research report from Mehernosh Engineerand Gregory Venizelos of the PNB Paribas European Credit Research team.in which they argue that capital flight is already effectively taking place.

Meanwhile over at Nomura they are already speculating on how assets will be denominated after break up:

and giving advice to clients on the legal ins and outs of asset redenomination. Closing time in the gardens of the west anyone?

While perennial optimist Paul Krugman puts the situation really quite succinctly on his blog.

Incidentally, if you can't read any of the inserts, try clicking over them to get a magnified version.

Subscribe to:

Posts (Atom)