Well it's pretty clear to me at least that there is now one, and only one, major and outsanding topic towering head and shoulders above all those other pressing and important problems those of us following the EU economies currently find lying in our macro-policy in-trays: the issue of wage cuts. Not since the 1930s has the possibility of such a generalised reduction in wages and living standards loomed out there before policymakers, and doubly so if we now hit - as I fear we may well for reasons to be explained at the end of this post - systematic price deflation in a number of core European economies.

The issue that has suddenly and even violently erupted onto the European macro horizon over the last week (as if we didn't already have sufficient problems to be getting on with) is, quite simply, how, if they either don't want to, or can't, devalue, do politicians successfully go about the business of persuading the people who, at the end of the day, vote them into office (or don't) to swallow a series of large and significant wage cuts? And this is no idle and abstract theoretical problem, since in the space of the last week alone the issue has raised its ugly head in at least four EU member states - Ireland, Greece, Latvia and Hungary.

In the case of the first two of these devaluation simply isn't an option, since there is no a local currency to devalue, while in the case of the latter two the presence of prior large scale foreign currency borrowing means that authorities are nervous about anything that smacks of devaluation (since the providing banks would take large losses following the inevitable defaults, and the cooperation of these providing banks is necessary in the future if the economies in question are ever to recover). This latter view (no devaluation) prevails even though many economists, (

including myself), would argue that is a highly questionable one, since wage deflation on a sufficient scale will ultimately produce those very same defaults (with the added schadenfreude,

as Paul Krugman points out, that even those who have borrowed in the domestic currency are also pushed into default).

War of the Sicilian Vespers Part IINow, there is already quite a debate going the rounds on the merits or otherwise of devaluation in the Latvian case (see

IMF Central European representative Christoph Rosenberg here or

RGE Monitor analyst Mary Stokes here), but what I want to focus on in this post is the acute difficulty faced by any elected politician when it comes to enforcing wage cuts. This has to be one of the most important arguments in favour of devaluation, at least from the practical policy point of view. And this is also why, in my humble opinion, the IMF constantly ends up being the whipping boy, since the easiest way for any local politician to try to side step the responsibility for taking difficult decisions is to throw the country to the mercy of the "dreaded" fund (or at least, as seems to have happened in last weeks Irish case, threaten to do so), and then tell everyone that there simply is no alternative, as "they" will accept nothing less.

All this puts me in mind of the popular urban legend according to which mothers in Naples put the fear of god into their recalcitrant offspring by warning them that they'd better darn well behave since otherwise "the Catalans will come" (in reference to an infamous incident in the aftermath of the War of the Sicilian Vespers in which Catalan Commander Roger de Flor allegedly massacred 3000 Italian soldiers on his arrival in Constantinople - for default on a debt as it happens - simply because his mercenary troops had not been paid). Now mothers all over Europe are apparently telling their children "lock the front daw, Dominique Strauss Kahn is Coming".

The Irish Gaffe, Or Just Another Load Of Old Blarney?First Up this week was Irish Prime Minister Brian Cowen, whose alleged threat to call in the IMF if the trade unions did not agree there an then to all overall 5% wage cut for public sector workers (a threat which was subsequently denied) made quite a few waves in the press and even got as far as producing

an official denial on the part of the Fund.

Prime Minister Brian Cowen, while at an investment conference in Tokyo on Wednesday, was reported to have endorsed the view of an Irish union leader that the parlous state of Ireland's public finances could lead to the IMF ordering mass dismissals of public sector workers. Dan Murphy, the general secretary of the Public Service Executive Union, had previously told his branch members that the Fund could intervene if public spending was not curtailed, according to the Irish Times......As for public sector wages, the prime minister's comments may simply have been an attempt to scare unions into agreeing to public sector wage cuts. That ploy "may have backfired somewhat," for all the attention it has now received, remarked Rossa White, chief economist at Davy stockbrokers.

Around 20.0% of Ireland's 1.2 million-strong workforce get their salaries from the state. While that proportion is not unusual in Europe, wages are unusually high, as are their accompanying pension benefits. The Irish government is now working to scrap a 6.0% pay increase it announced last September--badly timed to have launched around the time of Lehman Brothers Holdings' collapse--and White believes another 10.0% cut is needed.

Lightening Trip To HungaryCowen was swiftly followed out of the starters box by IMF Managing Director Dominique Strauss-Kahn who must certainly have been the highest profile vistor to pass through the VIP lounge at Budapest Ferihegy's airport last week as he found himself having to take time out to fly-in and offer a spine-stiffener to a government who were giving every indication of backtracking on the 8% public sector wage cut they had agreed to as one of the conditions for the 20 billion euro IMF-lead rescue loan. Strauss-Kahn arrived amidst a notable weakening in the value of the forint, and all manner of speculation about whether or not the fund was set to withhold the second tranche of the loan.

At the heart of last week's visit were concerns about the size of Hungary's 2009 budget deficit, since while Hungary has been steadily reducing the size of the deficit as part of the austerity programme agreed to in the summer of 2006 and the deficit was down to around 3.3% of GDP last year, according to Finance Minister János Veres last Tuesday, it is not clear what impact the recession will have on the 2009 target number of 2.6%. And we still need to say "about" 3.3% for the 2008 deficit since we evidently don't have a final figure for Hungary's 2008 GDP on which to make a more precise calculation.

The days before Strauss-Kahn's visit were rife with speculation that Hungary might be forced to adopt new austerity measures in order to stay on track with its deficit target, with analysts estimating Hungary could be set to overshoot the target by something in the region of HUF 200 billion-HUF 250 billion, due to the recession being deeper than expected and a sudden drop in inflation. Lower than anticipated GDP growth is important since Hungary currently has an estimated 0.9% contraction pencilled-in for its fiscal calculations, while in reality the final outcome may be anywhere between minus three and minus five percent, depending on the view you take (in fact the EU Commission Hungary 2009 Forecast - out today has -1.9, but this is almost certainly too optimistic). Also the sudden drop in inflation is also taking everyone by surprise, since if prices are lower than expected then VAT returns etc will be down accordingly, too. Hungary's inflation stats will likely undershoot the current forecast, Veres emphasized, confirming analyst expectations for a significantly lower inflation path for Hungary (the current market consensus for annual inflation in December 2009 is 2.6%, but again personally I think this is way too high).

"Currency traders in London took a sentence out of context in last night's media reports (which included Portfolio.hu coverage) which said the International Monetary Fund might cancel October's credit agreement with Hungary. This was the main reason for extreme pressure on the forint this morning," a Budapest-based trader told Portfolio.hu. After this morning's statement by Finance Minister János Veres, who claimed it was “impossible" for Hungary not to meet fiscal targets (or else the government was ready to take further austerity measures), market players began to see that the panic was unsubstantiated. As a result, we have seen an intense correction towards midday, the trader argued.

Portfolio Hungary Report

So Hungary's 2009 budget is in trouble, and this is partly due to exaggerated inflation and growth forecasts, and partly due to some hefty government compensation for state employees who lost their “13th month" bonus at the end of 2008. Arguably it was this latter point which was the main reason for the IMF Managing Director's visit. Strauss-Kahn met with Prime Minister Ferenc Gyurcsány, Finance Minister János Veres and National Bank of Hungary Governor András Simor, President of opposition party Fidesz Viktor Orbán, and a number of MPs, according to the IMF press release.

Apart from putting a stop to any kind of "back door" compensation for wage cuts, the tangible outcome of the meeting was a battery of agreed measures intended to bring the budget deficit back into line with targets.

“In order to partially offset the loss of budget revenues, we do not want to rule out the possibility of tax hikes," Hungary's Finance Minister János Veres told a morning talk show on Hungarian TV channel ATV. Veres did not make direct reference to a VAT hike, but recent press leaks and comments from analysts suggest that this may well be in pipeline.

Naturally Strauss-Kahn explained at his post meeting press conference that the International Monetary Fund was generally satisfied with Hungary's efforts to meet the conditions for the IMF loan (he was, of course, hardly likely to say otherwise in public), and he even dangled out the possibility that the loan might be extended beyond 2010 if economic condititions made it necessary. We will return in the future to this point, since as I personally cannot see the present plan working as anticipated, I cannot help asking myself when it will be (if ever) that Hungary is able to be discharged and certfied as fit to stand on its own by the fund. Or are we about to see the creation of a new set of Fund Economic Protectorates, a possibility which I'm sure was never envisaged by the institution's founders.

How To Dangle Your Government On The End Of A Very Thin Thread Latvian Style

But things were obviously a lot hotter under the collar (despite the snow) in Riga round about the same time, since according to

the Financial Times Latvia’s president threatened to call early elections last Wednesday after anti-government protests led to the Baltic country’s worst rioting since independence in 1991.

“It’s going to bring down the Parliament, and through that the government,” said Krisjanis Karins, a member of Parliament and former leader of the opposition New Era party. “It’s already happening, and the pace is such that nobody really understands.”

Such demonstrations - and similar ones in Bulgaria and Lituania (shown in photo) - raise doubts over whether Latvia’s government actually has enough political and social capital to implement the painful austerity plan agreed with the International Monetary Fund last month as an alternative to devaluation.

“Trust in the government and in government officials has collapsed catastrophically,” President Valdis Zatlers told a news conference. “The Saeima [parliament] and the cabinet of ministers have lost links with the voters.”

About 10,000 Latvians demonstrated in Riga’s Dome Square on Tuesday night in a rally called by opposition parties, trade unions and civic organisations. The demonstrators accused the government of corruption and of economic mismanagement and demanded that elections – not due until 2010 – be brought forward. The government now forecasts that the economy will contract 5 per cent this year and unemployment will soar to 10 per cent.

The Latvian government is well aware that strong adjustment will be needed to ensure success. In fact, most of the tough measures—including a nominal wage cut in the public sector of no less than 25 percent—was proposed by the Latvian government itself. This shows that the economy—including the labor market and the wage-setting mechanism—is very flexible, much more flexible than in most other countries, even outside Europe. The IMF is supporting the government's policy package through a $2.4 billion loan, with the EU, the World Bank, and a number of bilateral creditors providing additional financing.

Marek Belka, Current Head of IMF's European Department, quoted in IMF Helping Counter Crisis Fallout in Emerging Europe, IMF Survey Magazine.

What really seems to have angered people are the conditions attached to the €7.5bn stabilisation package agreed last month with the International Monetary Fund and the EU after the nationalisation of the country’s second largest bank shook confidence in the country’s fixed exchange rate. In particular Latvian citizens seem to have been upset by the stringency of the austerity package since in the letter of intent Latvia undertakes to limit budget spending to under 40% of GDP, and this in the context of a sharp contraction in GDP is not an easy thing to do- Clearly not of the envisaged measures are popular - cutting wages in the government sector by about 15%, freezing pensions as well as cutting back government spending on goods and services. And in addition to the cut in provision an increase in VAT is also being contemplated. All this contrasts, however, with the measures envisaged for restructuring the banking sector, including recapitalization of banks, honoring liabilities via the deposit guarantee fund and ensuring the maintenance of confidence in the various liquidity instruments, all of these areas of spending where increases in spending will be permitted. Of course, once you decide to stay on the peg there is no avoiding this, but it is hard for ordinary people to understand that this is not simply favouring Nordic banks at the expensive of Latvia's pensioners and unemployed.

Its All Greek To Me

Greece, as ever, is steering a rather different course. In the Greek case it is not the IMF who is waving the big stick, but the credit rating agencies, in the shape of Standard & Poor's who last week cut its credit ratings on Greece's sovereign debt, already the lowest in the 16-nation euro zone, to A- with a stable outlook from A. Greece was only one of four euro zone countries who have been warned by S&P recently that they may have their ratings cut, and ideed Spain has only today had its rating cut too.

"The ongoing global financial and economic crisis has in our opinion exacerbated an underlying loss of competitiveness in the Greek economy," S&P credit analyst Marko Mrsnik said. "In our opinion, the ongoing slowdown in credit growth will likely lead to a deceleration in domestic demand, thus increasing the risk of a recession and a possibly protracted adjustment."

S&P said Greece was entering the downturn with a fiscal deficit of around 3.5 percent of GDP, after repeated government failures to bring expenditure under control and reduce high debt levels despite years of economic growth averaging four percent. Following the announcement, spreads in Greek 10-year government bonds over benchmark German Bunds widened by about 10 basis points to a session high of 246.9 basis points.

The extra interest Greece must pay to borrow money for 10 years as compared with Germany stands at 246 basis points, while for Ireland the figure hit 180 basis points, also a record, and spreads have widened too for Spain and Portugal.

Wage moderation and enhancing wage flexibility are important challenges. The authorities will continue with the policy of containing increases in basic wages of government employees and are hoping for a favorable signaling effect on private sector wage settlements. However, in recent years, wage increases in the private sector have been relatively large and often exceeded productivity growth.

Greece: 2007 Article IV Consultation - IMF Staff Report On Greece

It should not surprise us then to learn that one of the key areas of controversy behind the recent Greek protests was a law which effectively ended the employees' right to collective wage contracts - a law which won approval in the Greek parliament last August. The government justified the move by saying that it wanted to clean-up debt-ridden state companies and overhaul protective employment laws in an attempt to attract more foreign investment. The now-dismisssed Greek Finance Minister Alogoskoufis recently told parliament the reform should be pushed ahead "for the sake of the Greek economy and society," since higher wages have added to state companies' debts, which ordinary Greeks had to cover with their taxes.

A much fuller review of the Greek problem can be found in my "Why We All Need To Keep A Watchful Eye On What Is Happening In Greece" post.

So What Are The Options?

IMF Survey Online: The IMF appears to be advocating fiscal restraint in all of its loan programs in Europe. Wouldn't these countries recover faster with fiscal stimulus packages?

Marek Belka: The answer is obvious: can a country finance its borrowing requirements or not? If only these countries could afford a larger budget deficit, fiscal stimulus would have been fine. But when a country is already in crisis, the main problem is usually to come up with enough liquidity. In these cases, fiscal restraint is necessary. Choices in a financial crisis are very constrained.

Well really there are no very easy solutions here, and anyone who suggests there are is kidding you. In all the countries we are talking about above (and a good few more) the citizens, and the corporates (and in some, but not all, cases the governments) are very highly leveraged (indebted in relation to their realistic future income expectations) and the debt accumulation process has pushed living standards to a level which is higher than sustainable. Just think of your own household. If you push all the available credit to its limit during the first half of a year, its clear you can't live on the same level in the second half unless you keep borrowing, but when the lenders not only won't allow you to do this, but even have the nerve to ask you to pay some of your borrowings back, well then your standard of living in the second half is bound to drop, and this, of course, is what is happening across all these countries.

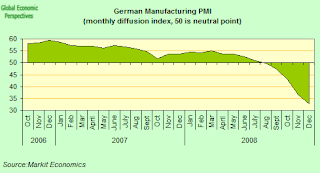

There is an additional problem here, however, since all that "over-the-top" borrowing drove these countries forward above their normal "capacity" level, and that is also what all the above four economies have in common. This driving-forward beyond capacity is what is called "overheating", and this overheating is normally reflected in above average inflation, which is again what we have seen in these countries. The end product is that they have not only an indebtedness problem but also a competitiveness one, and that is what the IMF packages are intended to address.

Of course, the problem is if you get your salary cut it becomes harder to pay back the money you owe (loan defaults) and you can't spend as much on consumption (demand slump). And on top of this, as these first two lock-in, government revenue falls (less VAT) while expenditure rises (unemployment payments and bank bailouts), so we get fiscal deficit problems. So not only do you have banks lending less, households spending less, and companies investing less (as demand drops), we also have governments finally forced to cut back (at least in the more vulnerable economies), as the ratings agencies get to work. So you get a downward spiral of falling wages, and falling prices as GDP just comes down and down. And this process can become systematic (deflation) meaning that nominal GDP starts falling even faster than real GDP, making for a car that becomes increasingly "wobbly" and difficult to steer.

In this environment, there really is only one way to halt the spiral, and to jump start the economy, and that is to export, and to try and encourage export directed investment. But to get going with exports you need to recover competitiveness. You can achieve some of this restoration via productivity improvements, but not enough, and not quickly enough, especially if the distortion is large, and has been going on over a number of years (see the real exchange rate chart for Hungary above). So you can either do one of two things, devalue, or cut wages and prices. Neither is easy, but as we are now seeing the second is hardly universally popular either.