"There is a difficulty that is widely recognized that the amount [of debt] to be repaid is high in 2014 and 2015," Giorgios Papaconstantinou (the Greek Finance Minister).

"We are confident that Greece will be able to return to the markets. But whether it will be able to return to the markets on a scale that allows Greece to pay off its European partners and the IMF, that is a question."..."We have a number of options. If paying off the €110 billion loan proves to be a question, we stand ready to exercise some of those options" - Poul Thomsen, head of the IMF team in the ECB-EU-IMF troika delegation.

"In the rushed last-minute deal to forestall certain bankruptcy, everyone missed one very important fact. That the memorandum created an unrealistic and immense borrowing squeeze on the feckless Greek state for the next five years."

Nick Skrekas - Refusing Greek Loan Extensions Defies Financial Reality, Wall Street Journal

Get On The Right Track Baby!According to the latest IMF-EU report Greece’s reform programme remians “broadly on track” even if the international lenders do acknowledge that this years fiscal deficit target will now not be met and that a fresh round of structural measures is needed if the country is to generate a sustained recovery. My difficulty here must be with my understanding of the English lexemes "remains" and "sustainable", since for something to remain on track it should have been running along it previously (rather than never having gotten on it), and for something - in this case a recovery - to be sustained, it first needs to get started, and with an economy looking set to contract by nearly 4% this year, and the IMF forecasting a further shrinkage of 2.6% next year, many Greeks could be forgiven for thinking that talk of recovery at this point is, at the very least, premature. A more useful question might be "what kind of medicine is this that we are being given", and "what are the realistic chances that it actually works". Unfortunately, in the weird and wonderful world of Macro Economics, witch doctors are not in short supply.

As the representatives of the so-called `troika`mission (the IMF, the ECB, and the EU) told the assembled journalists in last Tuesday's press conference “The programme has reached a critical juncture." Critical certainly (as in, in danger of going critical - just look at the 1,000 basis point spread between Greek and German 10 year bond yields, or the 4% contraction in GDP we look set to see this year), but the question we might really like to ask ourselves is what are the chances of the patient surviving the operation in one piece?

The statement came at the end of a 10-day mission visit to Athens to review the extent to which the country was complying with the terms of the country’s €110bn bail-out package and take a decision on whether or not to authorise the release of the third tranche of the agreed loan.

In the event the decision was a foregone conclusion, with the rekindling of the European Sovereign Debt Crisis as a background, and the very survival of the common currency in the longer term in question, this was no time to tell the markets the tranche was not being forwarded. But still, the expression "on track" continues to fall somewhat short of expectation with the lingered issues like the recent upward revision of the Greek deficit numbers (up to 15.4% for 2009), the failure to increase revenue as much as anticipated, and the need for a further round of “belt tightening” measures in 2011 to try to attain the agreed objective of a 7.4% deficit as a backdrop. The upward revision in the deficit numbers only added to all the doubts many economists have about the long term payability of the Greek debt, which the IMF now expect to peak at around 145% of GDP in 2013, although again, many analysts put the number much higher.

Independent analyst Philip Ammerman who is based in Greece, and whose expectations about the evolution of Greek debt have proved to be reasonably realistic,

now expects debt to GDP to come in much higher than anticipated in 2010, due largely to 10 billion euros in debt from the train company OSE being added to the total and downward revisions in 2009 GDP from the Greek statistics office.

The key to payability is of course a resumption of economic growth, which at the present time looks even more distant than ever. The IMF is arguing for another round of structural reforms – like opening up “closed-shop” professions, or simplifying administrative procedures and modernising collective wage bargaining, and while many of these are necessary, none of these are sufficiently “short sharp shock” like to restart the economy, and in general don’t target the main issue which is how to restore competitiveness to the country’s struggling export sector.

Just One More Moment In Time!Doubts about how Greece was going to start financing its debts in the market after the expiry of the loan programme in 2013 had only been adding to market nervousness in recent days, since in addition to the fact that loan repayments to the EU and the IMF would need to start in 2014. Most critical are the first two years, when the bulk of the debt to the EU and IMF falls due. Under current repayment schedules, In fact, as things stand now, Greece's gross borrowing needs for 2014 and 2015 (when most of the EU-IMF debt falls due) will balloon to over 70 billion euros a year from around 55 billion euros a year in 2011-2013. This represents having to finance about 40% of GDP each year. Not an easy task. The difficulty presented by this looming repayment mountain lead the FT’s John Dizard to speculate that the Greek parliament might be tempted to go for the rapid passage of a law allowing for the application of “aggregate collective action” on bondholders – using the reasoning that, since the money being borrowed at the moment is basically being used to pay off existing bondholders (who are relatively easy to haircut) while the new lenders (the IMF and the EU) are (at least on paper) not. As John says, “Greece is exchanging outstanding debt that is legally and logistically easy to restructure on favourable terms with debt that is difficult or impossible to restructure. It’s as if they were borrowing from a Mafia loan shark to repay an advance from their grandmother”.

What a (retroactive) aggregate collective action clause would mean is that if a specific fraction, say 80 per cent or 90 per cent, of existing Greek bondholders agree to a restructuring that lowers the net present value of Greek debt by, say, half, then the remaining “holdout” bondholders would be forced into accepting the same terms. It is the consideration that the Greek Parliament might be tempted to go down just such a road that possibly lies

behind this weekends Reuters report that The EU and the IMF could extend the period in which Greece must repay its bailout loans by five years, to make it easier for it to service its debt. According hot the agency Poul Thomsen, the IMF official in charge of the Greek bailout, stated in an interview with the Greek newspaper Realnews "We have the possibility to extend the repayment period ... from about six years to around 11," This follows earlier reported statements from Mr Thomsen the the IMF “could provide part of the funding on a longer repayment period, or give a follow-up loan.” Indeed the announcement of the Irish Bailout details seems to suggest there has been a general change of position here, since the Irish loan is initially to be for seven and a half years (which certainly does suggest we are all trying hard to kick the can further and further down the road), while - in what you might think was a token nod in the direction of John Dizard's argument, aggregate collective action clauses are now to be written into all bond agreements after 2013. It will be interesting to see how the existing bondholders themselves respond to this proposal when the markets open tomorrow (Monday) morning.

So now we know that in fact Greece is likely to be able to extend its dependence on the IMF all the way through to 2020, the only really major question facing us all is: just how small will the Greek economy have become by the time we reach that point.

To start to answer that question, let’s take a look at some of the macro economic realities which lie behind the “impressive start” the Mr Thomsen tells us the Greek economy has made.

Austerity Measures Provoke Sharp Economic ContractionThe IMF-EU-ECB austerity measures have - predictably - generated a sharp contraction in Greek GDP, with falling industrial output, falling investment, falling incomes, falling retail sales, and rising inflation and unemployment. The big issue dividing Macro Economists at this point is whether countries forming part of a currency union which have a competitiveness problem are best served by their fiscal difficulties being addressed first.

Arguably countries which do not have the luxury of implementing a swift and decisive devaluation to restore their competitiveness would be best served by receiving fiscal support from other part of the monetary unionion to soften the blow as they implement a comprehensive programme of internal devaluation to reduce their price and wage levels. That is to say the current approach has the issue back to front, and will undoubtedly lead the countries concerned into even more problems as slashing government spending at a time when no other sector is able to grow is only likely to create a vicious spiral which leads nowhere except towards eventual and inevitable default. To date Greek GDP has fallen some 6.8% from its highest point in Q1 2008, yet far from bottoming out, the contraction seems to be accelerating under the hammer blows of ever stronger fiscal adjustments, and the downard slump still has a long way to go.

The Greek economy contracted by 1.1% quarter-on-quarter in the third quarter of 2010, making for the eighth consecutive quarter of contraction. And evidently there are still have several more quarters of GDP contraction lying out there in front of us.

Year on year the Greek economy was down by 4.5% on the third quarter of 2009. This is the fastest rate of interannual contraction so far. Far from slowing the contraction seems to be accelerating at this point.

Domestic Consumption In Full Retreat

Domestic Consumption In Full RetreatLooking at the chart below, it is clear that Greece enjoyed quite a consumption boom in the first years of the Euro's existence, a boom which is in some ways reminiscent of those other booms in Ireland and Spain, and a boom which came roundly to an end when the credit markets started to shut down. As in other countries, the government stepped in with borrowing to try to keep the boom going, with the major difference that deficitfinance went to levels well beyond those seen in other European countries in 2009, as did the efforts the Greek government went to to try to cover its tracks.

One of the clearest indications that the party is now well and truly over is the way in which the level of new car registrations is slumping.

Retail sales have now fallen by something over 15%.

And With It The End Of The Credit Boom

And With It The End Of The Credit BoomThe Greek consumption boom came to an end, just as it did in Spain and Ireland, when the credit crunch started to bite in 2008. Pre-crisis household borrowing was increasing at the rate of around 20%, the interannual rate of change has now fallen more or less to zero, and will stay there for some time to come. Since in a mature modern economy aggregate demand (whatever you do in the way of supply side reforms) can only grow in a sustained way as a result of either credit expansion or exports, export growth is going to have to give the Greek economy what little demand growth it can eventually get.

Along with the general stagnation in household credit, lending for mortgage borrowing has also ground to a sharp halt.

And credit to companies has also become pretty tight if we look at the next chart.

Asin many other heavily indebted countries (the US, the UK, Spain) the only sector which is still able to leverage itself is the public one, or at least which was still able to drive demand by leveraging itself, but now, with the IMF EU adjustment programme, increases in government borrowing are also going to suddenly come to an end, with the evident consequencethat the economy goes into reverse gear. I can't help feeling that people aren't using enough emotional intelligence here. Obviously people are outraged by the level of fiscal fraud that was going on in Greece. But outrage and demogogic press headlines seldom form the basis of sound policy. Arguably the competitiveness issue is more important at this point than the fiscal deficit one, since the position is asymmetric - solving the competitiveness issue will automatically open the door to solving the fiscal deficit one, while addressing the fiscal deficit does not necessarily resolve the competitiveness problem, and does not return the country to growth - only a strong supply side dose of ideology can lead you to (mistakenly) think that.

The Best Way Not To Restore Competitiveness: Raise VAT

The Best Way Not To Restore Competitiveness: Raise VATIn fact, the fiscal adjustment programme contains two components, reducing spending, and increasing taxes. Of these the most damaging measure as far as growth and competitiveness goes is without doubt the decision to raise VAT by 5%. Not only (as we shall see) does this increase not raise the extra money anticipated (in an economy which is increasingly export dependent the tax base for a consumption tax weakens by-the-quarter in relative terms), it also sharply raises the domestic inflation rate, effectively ADDING to the competitiveness problem. I would say this obsession of the IMF with raising VAT in these economies which are effectively unable to devalue is just plain daft, frankly. And it doesn't impress me how many times respected micro economists describe raising VAT as the most benign of measures: all this does is convince me that they don't really have an adequate understanding of how economies work from a macro point of view, and especially not export dependent economies.

As we can see in the chart below, the VAT rise not only adds to the consumer price index, it also affects producer prices, and even export sector producer prices, which are sharply up.

I would say that policymakers have fallen into two "Econ 101 simpleton" type errors here. The first is to think that since part of the objective is to raise nominal GDP to reduce debt to GDP, and since GDP is falling, raising the price level might help (I would call this the "fools gold" discovery), and the second is to imagine that since exports don't attract VAT, the impact is relatively benign, without stopping to think the the VAT hike also acts on inputs, and especially in an economy which suffers from chronic price and wage rigidity issues like the Greek one.

If a first year student had sent me these kind of arguments in a term essay, aside form awarding a "fail", I think would recommend to the person that they would perhaps be better off studying another topic, physics maybe, since the demonstrated aptitude for applied macro economics would be very low indeed. Could it be that bondholders who normally understand quite a lot more than many imagine about how economies work are also noticing this, hence their growing nervousness.

The incredible result of the application of this very short sighted policy is that in addition to the fact that Greece started out with a serious competitiveness issue with its most competitive EuroArea peers, like Germany.....

it has even hadits virtual currency revalued against the EuroArea average since entering the IMF sponsored programme, which is the exact opposite of what we need to see.

Export Lethargy Feeds The Industrial Output Slump

Export Lethargy Feeds The Industrial Output SlumpAs a result we are seeing no evidence of a Germany-type resurgence in export activity.

And in fact even though the trade deficit has reduced somewhat, it still remains a trade deficit.

Given the fact that domestic demand is falling, while exports stagnate, Greece's industrial sector is still in a sharp and continuing contraction.

A contraction which continued and even accelerated slightly in October, according to the most recent PMI reading.

Construction activity is in "freefall", as can be seen from the drop in cement output.

and the decline will surely continue, as new building permits continue to fall.

And private construction activity continues to drop.

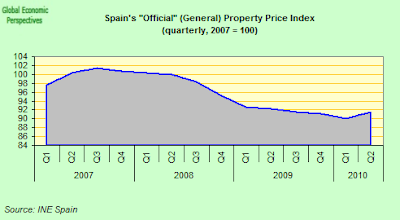

The net result of the economic contraction and a credit crunch is, of course, that while other consumer prices rise, house prices are now falling, giving us just one more reason why Greeks are starting to feel a lot less wealthy than they used to feel. Evidently, to kick start the economy again the fall in land and property prices needs to be brought to a halt. This is where the traditional devaluation strategy helped a lot, since you could stop the fall in nominal prices at a stroke, but the Greeks are helpless in this case, and it is rather alarming to find that there is no discussion of this key issue at the policy level, and just talk about how structural reforms will put everything right.

Employment Falls And Unemployment Surges

Employment Falls And Unemployment SurgesThe man and woman power is there to rebuild the economy, as ageing hasn't yet reached the point where the labour force will start to shrink. Indeed at this point it is still rising.

But, of course, employment is now falling.

And thus, logically, unemployment is rising, and is currently something over 12%.

And With The Fall In Employment Revenue Comes Under Pressure

And With The Fall In Employment Revenue Comes Under PressureAnd with the rise in unemployment, there is a fall in incomes, and thus income tax revenue is falling, putting yet more pressure on the deficit.

At the same time, and despite a 5% increase in VAT rates, returns on the tax are also not rising as hoped.

A Contraction Which Feeds On Itself?

A Contraction Which Feeds On Itself? The Greek fiscal deficit is now falling, but after the huge upward revision in the 2009 figure, getting it down towards this years 9.4% target is a more or less Herculean task, which will involve far more fiscal effort than was previously anticipated, and with the fiscal effort more economic contraction. In addition, the finance ministry recently reported that while Greece's central-government deficit narrowed by 30% in the first 10 months of this year, this still fell short of the targeted narrowing of 32% due to lower than anticipated revenue returns.

Finance ministry data show that the Greek central government took in 41.0 billion euros in revenue in the first 10 months of 2010, just 3.7% more than it did in the same period of 2009. The deficit-reduction plan hammered out with the EU and the IMF in May called for 13.7% growth in such revenues for 2010 as a whole. This implies that to meet the target, Greece must receive 14.1 euros billion in November and December, which is highly improbable given that to date this year the Greek government has only once had monthly revenue above €5 billion, and that was in January.

On the spending side things have gone better, and targets are being met. Indeed over the summer the Greek government put forward a revised plan that compensates for the lower revenue with deeper spending cuts. But even meeting the lowered target of €52.7 billion would require a 30% jump over last year's revenue for the last two months of the year, and this is well nigh impossible.

As a result of the revenue shortfalls and the revision in the 2009 deficit, Greece still looks to be well short of the 7.8% of GDP deficit originally aimed for. Current estimates are for a shortfall this year of something like 9.4% of GDP. In order to try to soothe market fears in this unsettled environment the Greek government last week unveiled a further austerity plan for 2011 involving an addition 5 billion euros in cuts, with the objective of cutting public deficit to 7.4% of GDP by the end of next year. Apart from the fiscal effort involved the new budget will almost certainly involve a stronger economic contraction than previously anticipated - and indeed the Greek government have already revised their forecast to 3% from the previous expectation of a 2.6% shrinkage.

The problem is, that Greece is in danger of a counterproductive downward spiral here, since the revenue shortfall is at least partially the result of the existing budget austerity, which has simply helped to squeeze an already weak economy. The expected sharp contractions in GDP this year and next, will weighing heavily on revenue from income and sales taxes. Cuts to public-sector paychecks that went into affect this summer, for instance, have certainly helped contribute to a fall of about 10% in retail sales in August and September, and continuing unemployment rising above 12% will only add to the banking sectors bad debt problems.

You Need To Attack The Competitiveness Issue, And Not Just The Fiscal Deficit OneIn my opinion the IMF are making a fundamental mistake in relying almost exclusively on structural reforms. "It has to come through structural reforms," Mr. Thomsen said, adding that he expected those reforms to be discussed at the next visit by the delegation early next year. "It cannot come through higher tax rates, that's not good for the economy, and it cannot come from more wage cuts because that is not fair."

The are right that more taxes and less salaries without corresponding price reductions don't solve the problem, but Greece needs to do something radical (like a sharp internal devaluation) to restore competitiveness rapidly. Pushing the issues out to 2020 is no solution, and it is hard to imagine Greek civil society will accept the levels of unemployment and social dislocation that are being produced for such a lengthy period of time.

Estimates of the future path of Greek debt vary a lot, and their is considerable uncertainty involved in any estimate. The IMF currently forecast that the debt will peak at just under 145% of GDP in 2013, but I think we can regard that as an estimate at the lower end of the range.

Despite the fact that George Papandreou's government has been widely praised for enforcing draconian austerity measures, the country still has the largest debt-to-GDP ratio in the EU, which involves a debt mountain of something like 330 billion euros - only 110 billion of which will be funded by the EU-IMF rescue programme. That is to say, private sector bondholders will still have something like (at least) 220 billion euros of exposure to Greek debt come 2013.

Greece's whopping current account deficit has reduced to some extent since the 2008 15% of GDP high, but the level is still quite large.

More importantly the IMF do not forsee Greece running a current account surplus at least before 2015. Indeed they imagine that Greece will still have a current account deficit of 4% of GDP come 2015. Which means that far from paying down their external debt, Greek indebtedness (absent restructuring) will continue to rise over the whole period. According to Greek central bank data, the country had a net external investment position of 199 billion euros in 2009, or put another way, net external debt was something like 110% of GDP.

At the end of last week, risk premiums on 10-year Greek bonds over their German equivalents were still timidly nosing above 1,000 basis points, a level many consider to be the market signal that default is likely. And this despite the International Monetary Fund having announced the same day that the Greek reform programme is “broadly on track”.

And then there is the return to the financial markets issue. Finance Minister George Papaconstantinou has repeatedly said the country would return to bond markets when the time was right sometime in 2011. This looks increasingly like wishful thinking, especially since the 2009 deficit revision by Eurostat, while the less than anticipated revenue performance means that Greece has already missed its first fiscal consolidation target. Such a lapse may convince inspectors from the EU and the IMF, but it is unlikely to cut too much ice with ultra conservative fixed income market participants.

And, as Nick Skrekas points out in the Wall Street Journal, the numbers simply don’t add up. Greece has to raise €84 billion to repay interest and principle over the next three years, even assuming the force of the economic contraction doesn't mean even more missed deficit targets . Add to that an additional €70 billion for each of 2014 and 2015 in repayment of EU-IMF loans, and the calculation equals an unavoidable default, which is what the markets are signalling with there 1,000 to the sky is the limit spread on Greek 10 year bonds over bunds.

Even in the pre-crisis days, Greece couldn’t realistically raise more than about €50 billion a year from markets that trusted it. And market participants know the ‘troika’ is being unrealistic in its expectations. Lack of conviction in the bond markets that Greece can survive without a default is creating a vicious cycle that keeps prospective borrowing costs elevated and thus makes eventual repayment even more unlikely. And round and round and round and round we go.

In this sense the troika’s earlier inflexibility over the repayment postponement issue has been entirely self-defeating. The delay in letting the markets know that extension was a possibility is rumored to have been in part due to the German government's worries about what the reaction inside Germany would be to the news. Evidently borrowers are going to be able to kick the can a lot harder and a lot further down the road than previously imagined. Indeed only today Ireland is seemingly to get money over a nine year term, which makes it hard to see how exactly the European Financial Stability Facility can be wound up in 2013 as previously planned - indeed the way things are shaping up it looks like 2013 could be the year when it really gets going.

Which, as John Dizzard notes in the Financial Times, would seem to create a new potential moral hazard problem, which is that if the funds in the pot are going to be limited, and if potential costs going forward are likely to be high, then we could see a rush to get in (before the funds are all used) with few in any hurry at all to leave. Giving Spain the prospect of 350 billion euros (or thereabouts) over seven and a half years mights seem very tempting, but it is unlikely that those in Rome would be happy to pay rather than join the queue standing next to the soup pot.

So, what this all boils down to is, that along with the EU and IMF we can be in no doubt: the reform programme evidently is on track. The only issue which seems to divide everyone - and especially those office-bound Fund employees from their more financially savvy market-participant peers - concerns the exact name of the station towards which the train in question is heading.